Introduction

The fascinating world of the stock market is a complex labyrinth that requires thorough navigation. One of the critical tools that has aided investors in this journey is understanding the concept of stock market seasonality. This intriguing aspect of the financial markets refers to the consistent patterns or trends that individual stocks or markets as a whole exhibit over specific periods. These patterns are often determined by a multitude of factors, including natural events, consumer behavior, investor sentiment, and production cycles.

The Significance of Stock Market Seasonality

Recognizing seasonal trends in the stock market can offer investors a strategic edge. By observing historical data, investors can predict specific time frames when stocks are likely to perform exceptionally well or disappointingly poor. This knowledge is crucial in devising effective investment strategies and making informed decisions. For instance, the well-known market adage “sell in May and go away” originated from a noticeable seasonal trend.

Seasonality Vs Cyclicality

Moreover, it’s pivotal to distinguish between seasonality and cyclicality in the stock market. While they both involve patterns, they differ in their causes and durations. Seasonality revolves around patterns recurring over a year, influenced by the calendar’s rhythm. On the other hand, cyclicality refers to fluctuations occurring over several years, driven by broader economic conditions. For a more in-depth understanding of how these two differ, refer to our article on Seasonality Vs Cyclicality.

Delving into Financial History

The financial history of stock market seasonality provides us with invaluable insights, enabling investors to steer clear of potential pitfalls and seize profitable opportunities. By comprehending the history of stock market seasonality, investors are empowered to enhance their portfolio’s performance significantly, making the most of the seasonal trends.

In the forthcoming sections, we will delve deeper into the historical timeline of stock market seasonality, unravelling its origin, evolution, and its profound impact on investment strategies. So, buckle up for an enlightening journey through the annals of financial history, as we uncover the pivotal role of seasonality in shaping the stock market’s landscape.

The Origins of Stock Market Seasonality

Seasonality, a recurring phenomenon in various sectors, has a rich tapestry in the sphere of finance. When we delve into the annals of financial history, we find the first traces of seasonality in the stock market.

Emergence of Stock Market Seasonality

The concept of seasonality started to gain prominence with the publication of the Stock Trader’s Almanac. The Almanac, a revered publication among investors, unveiled an interesting revelation. It stated that an investment strategy involving trading in stocks represented by the Dow Jones Industrial Average from November to April, and switching to fixed income for the remaining six months, would have consistently generated reliable returns with mitigated risk since the 1950s. This strategy was a testament to the inherent seasonality of the stock market that had been overlooked for so long.

Early Instances of Seasonal Trends

The earliest known instances of seasonal trends in stock market can be traced back to as early as the 18th century. The ‘Sell in May and Go Away’ strategy is one such example. This investment strategy suggests that investors should sell their stocks in May and refrain from any market activity until November. The rationale behind this strategy stems from the historical observation that stock market returns tend to take a dip during the summer months.

Another fascinating example of early stock market seasonality is the ‘January Effect’. This strategy advocates for the purchasing of stocks in December and holding onto them through January. The reasoning behind this strategy is rooted in the historical data that suggests a trend of stocks performing positively in the first month of the year.

These early instances of seasonal trends served as eye-openers to the investment world, revealing a layer of the stock market that was previously shrouded in obscurity. They marked the beginning of a new approach to investment strategies, one that took into account the seasonality of the stock market.

Stock Market Seasonality: A New Approach to Investing

The emergence of these seasonal trends led to a paradigm shift in the investment strategies employed by investors. Recognizing the impacts of seasonality on the stock market, investors began to incorporate these trends into their investment decisions.

This newfound focus on seasonality marked a significant departure from traditional investment practices. Instead of focusing solely on company-specific factors or macroeconomic indicators, more and more investors started to take into account the time of the year when making their investment decisions.

Indeed, the concept of stock market seasonality has come a long way since its early days. Yet, despite its age, its relevance in today’s complex and ever-evolving financial landscape remains undiminished.

For those who are new to this concept and wish to understand the basics of stock market seasonality, check out our beginner’s guide to stock market seasonality.

Understanding and leveraging the seasonality of the stock market can help investors make more informed investment decisions. After all, in the world of investing, knowledge is power. And as we’ve seen, sometimes, that power can be found in the seasons.

Major Milestones in Stock Market Seasonality

In the vast expanse of financial history, stock market seasonality has always played an integral part. Let’s journey back in time and explore some of the pivotal moments that have shaped our understanding of seasonal trends and influenced the evolution of investment strategies.

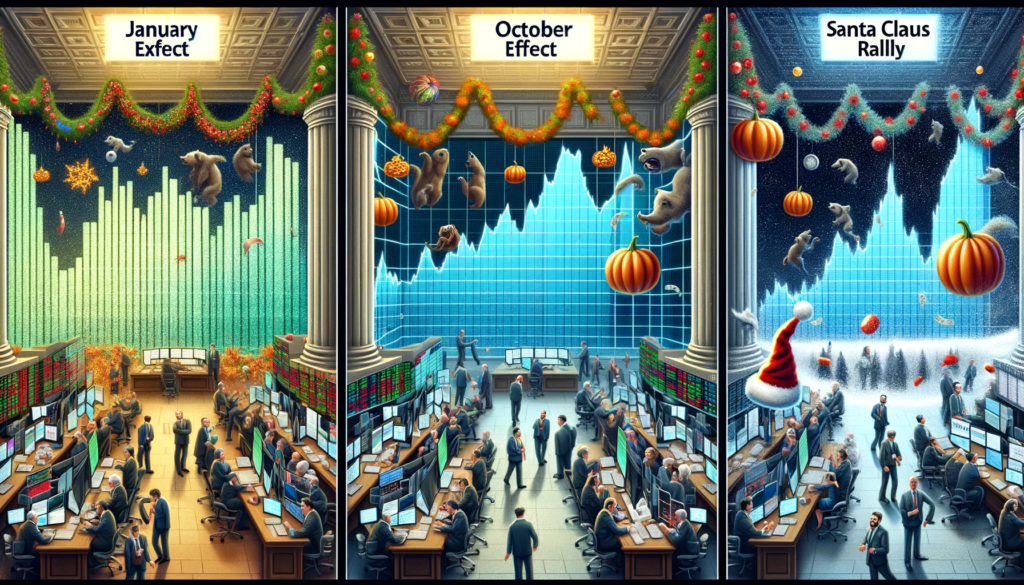

Discovering Seasonal Phenomenons: The January Effect

The emergence of stock market seasonality can be traced back to the identification of the ‘January Effect.’ This phenomenon suggests that buying stocks in December and holding onto them through January often results in potentially positive returns. This trend has been noticed consistently enough to become a cornerstone in the understanding of stock market seasonality.

The October Effect: A Season of Declines

Another milestone that marked its significance in the timeline of stock market seasonality was the discovery of the ‘October Effect.’ This refers to the historical tendency for the stock market to experience declines in the month of October. While not a rule, this pattern has been observed often enough to warrant attention from investors and analysts alike.

The Santa Claus Rally: A Holiday Boom

Adding to these milestones is the so-called ‘Santa Claus Rally.’ This phenomenon is observed in the last week of December and the first two trading days of January, often resulting in a significant uptick in stock prices. While the reasons behind this rally are still debated, many attribute it to increased holiday shopping, year-end bonuses, and the general sense of optimism and goodwill that permeates the season.

These are just a few of the key moments in the history of stock market seasonality. By analyzing these patterns, investors can make more informed decisions about when to buy or sell stocks. However, it’s important to note that these patterns are not guarantees— they are merely tools that can help guide investment strategies.

Seasonal Investment Strategies: Sell in May and Go Away

One of the most influential strategies that have emerged from the study of stock market seasonality is the ‘Sell in May and Go Away’ approach. This strategy, popularized by the Stock Trader’s Almanac, suggests investing in stocks from November to April and switching into fixed income for the other six months.

This seasonal approach to portfolio allocation aims to produce reliable returns with reduced risk. It’s based on historical patterns that suggest the stock market performs better in the winter months than in the summer.

As we look at these milestones, it’s worth noting that while these seasonal trends have shaped investment strategies over the years, they are not foolproof. Investors must conduct thorough research and consider their individual goals and risk tolerance before implementing any investment strategy.

For a more detailed look at the best months for stock trading influenced by these seasonal trends, check out our guide here.

| Year | Milestone |

|---|---|

| Early 20th Century | Discovery of ‘January Effect’ |

| Mid 20th Century | Identification of ‘October Effect’ |

| Late 20th Century | Observation of ‘Santa Claus Rally’ |

| Late 20th Century | Emergence of ‘Sell in May and Go Away’ strategy |

This timeline underlines key moments in the evolution of stock market seasonality. As we continue to learn and understand more about these patterns, who knows what new strategies and insights the future might hold. Stay tuned to SeasonalEdge as we continue to delve into the fascinating world of stock market seasonality!

The Impact of Seasonality on Modern Investment Strategies

Understanding the impact of seasonality on modern investment strategies requires knowledge of the financial history and the recognition of recurring seasonal trends. The phenomenon of stock market seasonality has been a key factor in shaping investment strategies, as it provides insights into the cyclical nature of the financial markets.

Seasonality and Investment Strategies: A Harmonious Relationship

Seasonality plays a significant role in shaping modern investment strategies. By examining historical data, investors can identify recurring patterns and trends, thus enabling them to make informed decisions about when to buy or sell stocks. Some prefer to focus on specific sectors that exhibit seasonal trends, such as retail during the holiday season or tax services during the tax filing season. This strategic approach to investing, based on the cyclical nature of the market, allows investors to potentially capitalize on stock price movements, trading volumes, and even market volatility.

The Legacy of Financial History in Modern Investing

The rich tapestry of financial history has left a significant mark on modern investment strategies. This legacy is apparent in the application of phenomena like the ‘January Effect’ and ‘Sell in May and Go Away’ strategies. According to the January Effect, stocks tend to perform well in the first month of the year, encouraging investors to buy in December and hold through January. The adage ‘Sell in May and Go Away,’ on the other hand, is based on a historical trend of stock market downturns in the summer months. Informed investors often adjust their portfolios accordingly to avoid potential losses.

Event-Driven Strategies: A Seasonal Approach

Investors often tailor their strategies based on specific events that can impact stock performance. For instance, some may choose to buy stocks before earnings announcements, banking on the anticipation and subsequent reaction to the report. Other event-driven strategies could revolve around political events known to impact the market. This approach, though not purely based on seasonality, still exhibits the principle of timing one’s investments based on predictable patterns.

The Role of Calendar Seasonality

Calendar seasonality is another strategy that takes into account the time of the year, including seasonal changes, holidays, and recurring events. The ‘Santa Claus Rally,’ a notable surge in stock prices during the last week of December and the first two trading days in January, is a prime example of a calendar-based strategy. Investors who are aware of these seasonal trends can potentially reap substantial benefits.

In conclusion, the impact of seasonality on modern investment strategies is evident. Whether it’s the historical legacies of the January Effect or Sell in May strategies, or the event-driven and calendar-based approaches, seasonality continues to shape the way investors navigate the stock market. However, while these strategies can provide valuable insights, it’s crucial to remember that they are just one piece of the investment puzzle. A well-rounded investment strategy should also incorporate other fundamental and technical analysis tools, ensuring investors are equipped to make the most informed decisions possible.

Frequently Asked Questions

What is ‘Sell in May and Go Away’?

‘Sell in May and Go Away’ is a renowned phrase in the investment world. This strategy is based on the historical data suggesting that the stock market tends to underperform between May and October. The strategy advises selling stocks at the beginning of May, retaining the proceeds in cash until November, then reinvesting in the stock market. The S&P 500 Index supports this adage, showing stronger average gains between November and April. However, it’s vital to remember that this pattern may not hold every year, and investors must consider other factors when making investment decisions.

Are Certain Months More Profitable in the Stock Market?

Indeed, historical data indicates that certain months are generally more profitable in the stock market. The period from November to April tends to be more profitable, while the period from May to October tends to underperform. This aligns with the ‘sell in May and go away’ strategy. Moreover, December and April have historically been strong months for the stock market, with the ‘Santa Claus Rally’ phenomenon observed in December. However, it’s crucial to remember that these trends are based on historical data, and future performance is not guaranteed.

Can Seasonality Guarantee Investment Success?

While seasonality trading can help investors identify consistent patterns over the calendar year, it cannot guarantee investment success. Seasonality should be incorporated as part of a broader investment strategy that includes diversification and risk management. Also, it should be used in conjunction with other fundamental and technical analysis tools. Despite some studies suggesting that seasonality-based strategies can outperform others, investors must stay vigilant and adapt to market changes.

How Can Investors Use Seasonality to Their Advantage?

Investors can leverage seasonality by identifying recurring seasonal trends and patterns in the stock market. This can potentially improve their profitability. Some strategies include calendar-based strategies, sector-based strategies, event-driven strategies, and intraweek strategies. However, seasonality is just one factor influencing the financial markets. Therefore, it should be used along with other fundamental and technical analysis tools. Proper risk management techniques are also crucial when implementing any trading strategy.

Conclusion

In our journey through the financial history of stock market seasonality, we’ve explored how understanding seasonal trends can shape effective investment strategies. We’ve seen how patterns like the ‘Sell in May and go away’ strategy have left an indelible impact on investors’ approaches.

However, as we venture further into the digital age, our understanding of seasonality is set to evolve. With advancements in machine learning and AI, we anticipate a future where granular, real-time seasonality analysis becomes the norm. Furthermore, the incorporation of alternative data will enhance our grasp on seasonal patterns like never before.

The legacy of stock market seasonality reminds us that while markets may change, patterns often endure. By staying informed, investors can navigate the stock market seas with the compass of seasonality, making strategic decisions based on these recurring trends.

In conclusion, the stock market seasonality isn’t just a relic of financial history, it’s a living, evolving entity that continues to influence the way we invest. As we look ahead, we can be certain that seasonality will continue to play a pivotal role in the stock markets of tomorrow.

“Make the invisible visible. My goal is to shine a light on the subtle seasonal signals in the stock market, providing investors with the insight needed to make informed decisions. By breaking down the complexities of seasonality, I strive to empower our audience with knowledge and foresight, turning data into action.”