Introduction

Welcome to the intricate dance of numbers and trends that dictate the stock market’s rhythm! As seasons change, so too does the financial landscape, presenting savvy investors with opportunities to capitalize on these cyclical shifts. In the bustling world of stock trading, there’s a hidden tempo to the rise and fall of share prices, a pattern that the astute trader can learn to read and respond to with precision. Our focus today zeroes in on Air Lease Corporation (AL), a key player in the aviation leasing sector, as we explore a trading strategy that harnesses the power of seasonality.

Embark on this intellectual expedition with us as we dissect the seasonal winds that influence stock performance. We’ll guide you through a strategy that isn’t just about picking stocks at random times; it’s about identifying the specific months when the shares of Air Lease Corporation historically take flight or descend. Imagine having the foresight to understand when to enter and exit positions with the confidence of historical data lighting the way. Our journey will not only reveal the potential of a meticulously backtested strategy but also offer insights into the broader implications of seasonal trends in the stock market.

Join us as we simplify the complex, transforming dense data into a narrative that can empower your investment decisions. Whether you’re a seasoned investor or new to the game, our insights into the seasonality of stock markets and trading strategies based on this phenomenon are your compass to navigating the temporal aspects of the stock market. Let’s embark on a venture that transcends the routine buy-and-hold philosophy, venturing into the realm where timing is everything, and strategy is king.

Company Overview

AL Air Lease Corporation, a global aircraft leasing company, plays a crucial role in the aviation industry by providing operating lease and purchase-leaseback arrangements for airlines worldwide. The company’s core services encompass the acquisition, leasing, and sale of commercial aircraft, enabling airlines to expand and modernize their fleets without the burden of large capital expenditures.

AL Air Lease’s target market primarily comprises airlines of varying sizes, ranging from major carriers to regional and low-cost operators. Its revenue streams are derived from rental income generated through lease agreements with airlines, as well as aircraft sales and leaseback transactions. The company’s value proposition lies in its ability to offer flexible leasing solutions, tailored to the specific needs of its airline customers, along with its extensive network of relationships in the aviation sector.

AL Air Lease operates on an asset-light model, maintaining a portfolio of modern and fuel-efficient aircraft leased to a diverse customer base. Its growth strategy emphasizes the expansion of its fleet through strategic acquisitions and the development of long-term relationships with airlines. Furthermore, the company actively seeks new markets and opportunities to enhance its global footprint.

The aviation industry presents both challenges and opportunities for AL Air Lease. Factors such as geopolitical uncertainties, economic fluctuations, and technological advancements can impact the demand for aircraft leasing services. However, the long-term growth prospects remain positive, driven by the increasing demand for air travel and the need for airlines to optimize their fleet utilization.

Overall, AL Air Lease Corporation stands as a prominent player in the aircraft leasing industry, offering tailored solutions to airlines and driving growth through strategic fleet expansion and market diversification. Its financial performance and industry expertise position the company for continued success in the dynamic aviation landscape.

Strategy Overview

In the dynamic world of stock trading, strategic timing can be just as crucial as stock selection. Seasonality patterns, which refer to the tendency of stocks to perform differently at various times of the year, play a pivotal role in shaping investment strategies. Today, we’re dissecting a unique approach applied to the shares of Air Lease Corporation (AL), an intriguing player in the aviation leasing industry.

This analysis delves into a monthly seasonality strategy executed from the close of one month to the close of the next, focusing on specific months believed to have a cyclical impact on AL’s stock performance. The strategy’s backtesting period spans from April 19, 2011, to December 29, 2023, encapsulating a total of 4637 days of trading activity. The aim was to capitalize on patterns identified in AL’s historical performance data.

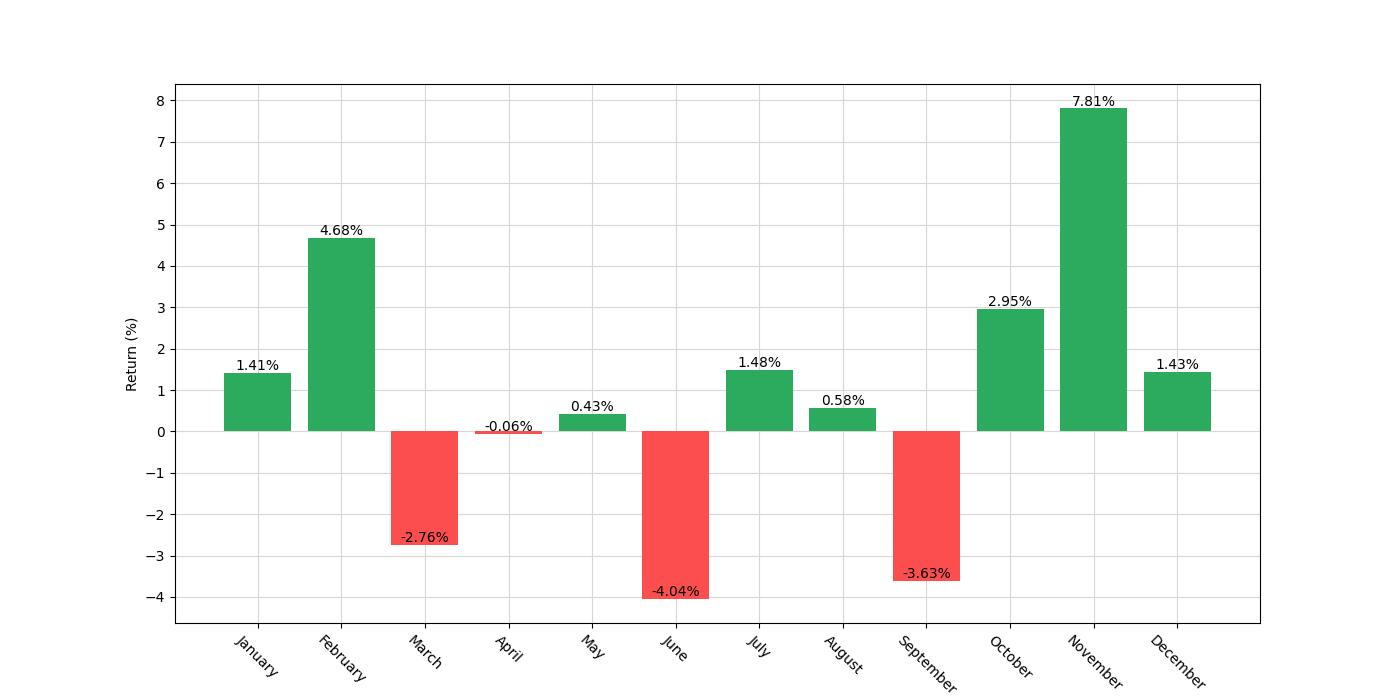

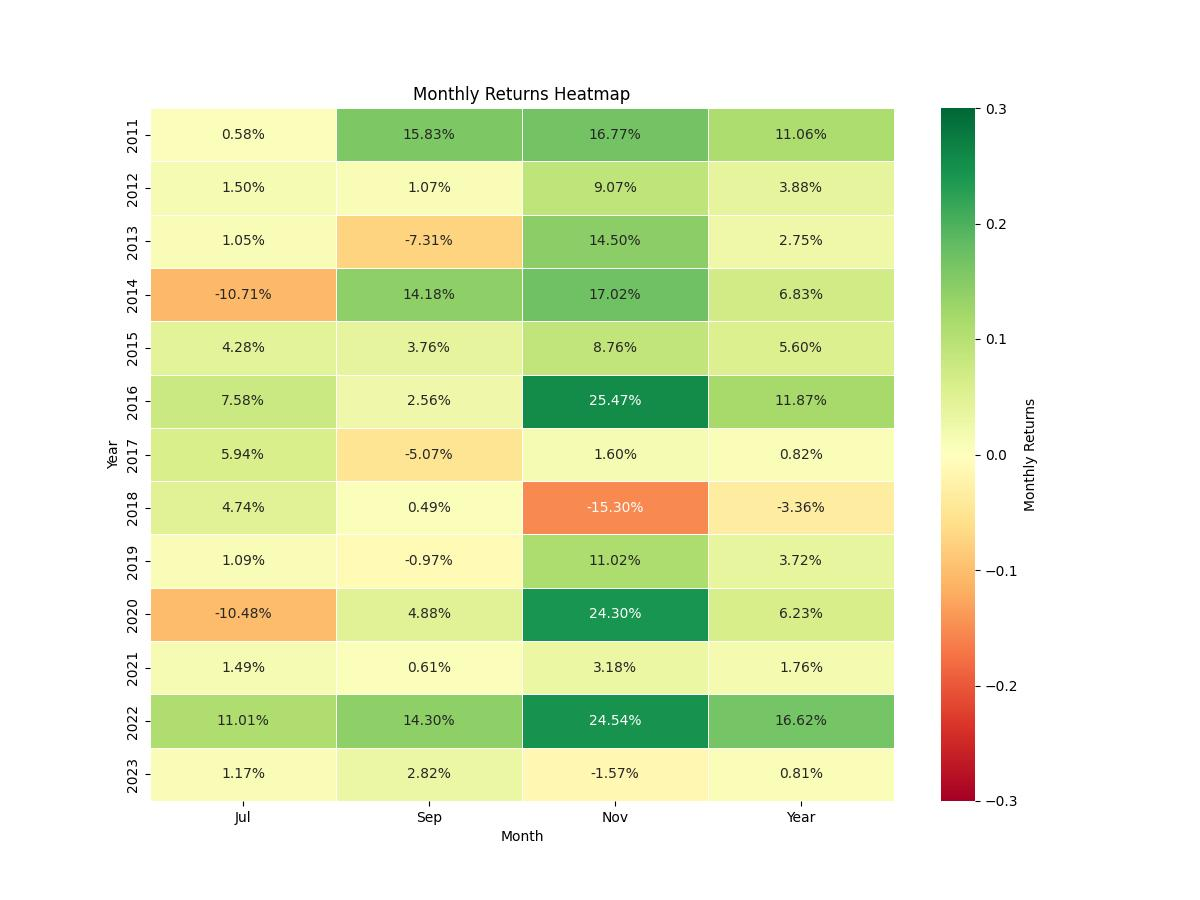

The rules of the strategy were straightforward: initiate a long position in the months of July, October, and November, and a short position during September. The rationale behind this selection of months hinges on historical patterns observed in the stock’s performance, suggesting that these periods typically experience distinct upward or downward trends.

Throughout the backtesting duration, the strategy’s exposure to the market was limited to approximately 34.92% of the time. This means that the strategy avoided market fluctuations for about two-thirds of the examined period, potentially reducing risk linked to broader market volatility.

The initial capital allocated for this strategy was set at $10,000. An essential aspect of this strategy was its focus on pure trading gains, meaning that the results did not account for transaction costs such as commissions or slippage, which can sometimes significantly impact the profitability of high-frequency trading strategies.

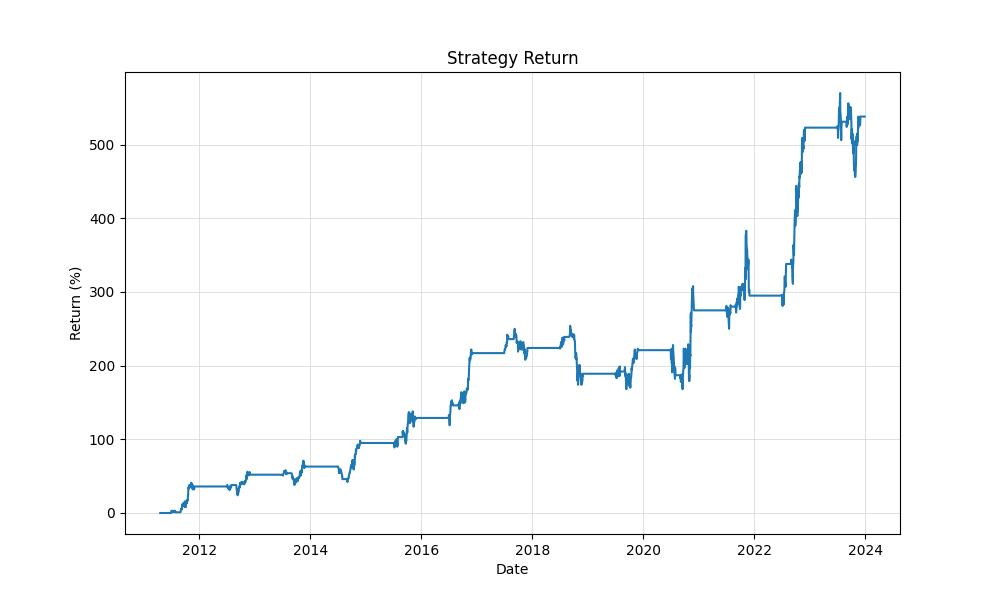

The backtest revealed that if an investor had followed this seasonal strategy rigorously, their initial capital would have burgeoned to an impressive $63,825.33 by the end of the testing period. This growth represents an overall return of 538.25%, a stark contrast to the buy-and-hold return of 70.66% during the same period. On an annualized basis, the strategy yielded a 15.74% return, which is a testament to the power of leveraging seasonality in trading strategies.

Understanding the performance of this strategy provides invaluable insights for investors considering a similar approach. It demonstrates the potential of seasonality-based strategies, particularly when they are backed by robust historical data and implemented with a disciplined, rule-based methodology.

Key Performance Indicators

When evaluating the efficacy of a trading strategy, it is paramount to consider its performance metrics against a standard investment approach, such as a ‘buy and hold’ strategy. In the case of Air Lease Corporation (AL), the backtested monthly seasonality trading strategy presents some intriguing results.

The strategy concluded with an impressive equity final of $63,825.33, a substantial increase from the initial capital of $10,000. This figure not only represents the closing balance of the account at the end of the backtesting period but also serves as a testament to the strategy’s potential for capital growth. In comparison, the equity peak, which denotes the highest value the account reached, was slightly higher at $67,011.56. This peak is indicative of the strategy’s ability to capitalize on favorable market conditions.

When we delve into the returns, the strategy boasts a 538.25% return over the backtesting period, which is significantly higher than the 70.66% return one would have received from a simple buy and hold approach with Air Lease Corporation. This stark contrast highlights the potential benefits of employing a more active trading strategy over a passive investment strategy, especially when considering the return on an annualized basis. The strategy’s annualized return stands at 15.73%, a robust figure that underscores the strategy’s effectiveness in generating consistent growth year over year.

However, it is important to recognize that these returns do not come without risk. The strategy’s annualized volatility, a measure of the variation in returns, is 21.95%. While this level of volatility may suggest a higher risk profile, it is important to compare it with the alternative. The buy and hold strategy’s annualized volatility was significantly higher at 45.19%, indicating that the active strategy managed to achieve its impressive returns with less fluctuation, which could be more palatable to risk-averse investors.

Ultimately, the numerical data demonstrates that the seasonality-based strategy for AL not only outperformed a passive investment approach by a considerable margin in terms of total and annualized returns but also managed to do so with a lower degree of volatility. This performance suggests that investors seeking to maximize growth potential while managing risk might find such a seasonality-based trading strategy to be a compelling approach to navigating the stock market.

Risk Management

In the realm of investing, where potential profits are inextricably linked with associated risks, a comprehensive understanding of the latter is paramount. The seasonal trading strategy applied to Air Lease Corporation (AL) reveals a nuanced picture of risk that demands careful consideration.

Firstly, the annualized volatility, set at approximately 21.95%, serves as a gauge of the fluctuation in the strategy’s returns over time. In comparison to a traditional buy-and-hold approach, which exhibited a notably higher annual volatility of around 45.19%, this seasonality-based strategy appears to offer a smoother investment curve. This reduced volatility suggests a more consistent performance, which can be particularly appealing to investors who prefer to minimize extreme ups and downs in their portfolio.

The Sharpe Ratio, a metric that evaluates the return of an investment compared to its risk, stands at 0.7169 for this strategy. This number indicates that for every unit of risk taken, a higher return was generated compared to a lower Sharpe Ratio of 0.0945 in the buy-and-hold scenario. It implies that the excess return, or risk premium, received per unit of volatility was more favorable, signaling a relatively attractive risk-adjusted performance.

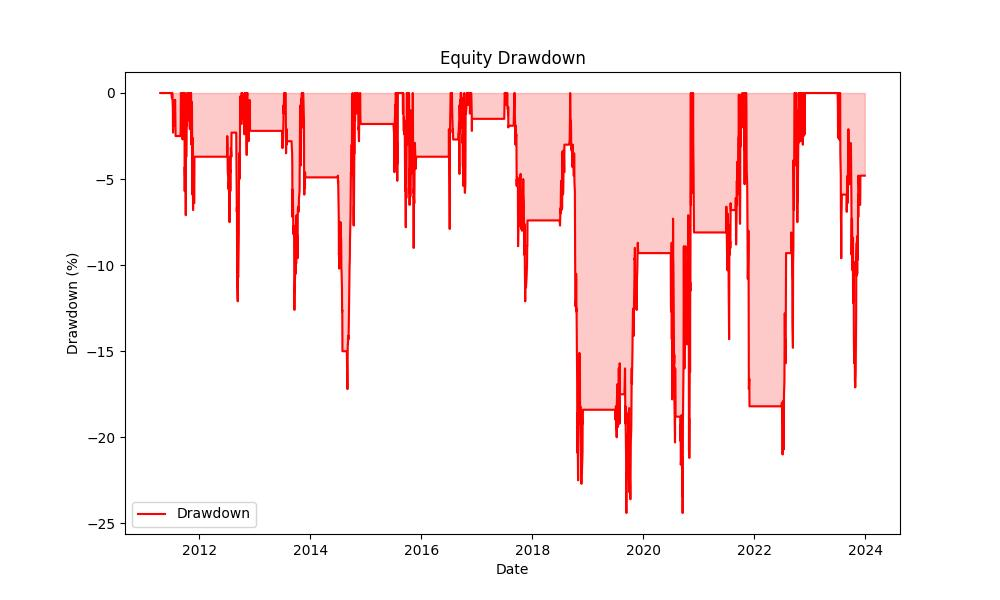

Addressing the magnitude of potential losses, the strategy’s maximum drawdown was recorded at -24.43%, a measure of the largest drop from peak to trough in the strategy’s value. This drawdown is substantial, yet it is significantly less severe than the -78.14% encountered in the buy-and-hold approach. The average drawdown, reflecting the typical decline experienced, was also lower at -4.29% compared to -11.47% for buy-and-hold, suggesting that losses were generally contained and less pronounced during the investment period.

Duration of drawdowns is equally telling. The maximum drawdown duration, the longest period the strategy was in a drawdown, was 794 days. While this may seem daunting, it pales in comparison to the buy-and-hold’s 1155 days. On average, the strategy recovered from drawdowns in 62 days, which is significantly quicker than the 159 days average recovery time for the buy-and-hold method. This faster recovery time can be a comforting factor for investors, as it indicates shorter periods of portfolio underperformance.

The thorough risk assessment of this monthly seasonality trading strategy provides an insightful perspective for investors. While no investment is without risk, the data suggests that this particular approach to trading Air Lease Corporation (AL) has historically managed to navigate market fluctuations with a steadier hand than a passive, long-term investment strategy. Investors considering this method should weigh these risk factors against their personal risk tolerance and investment goals to make informed decisions.

Trade Analysis

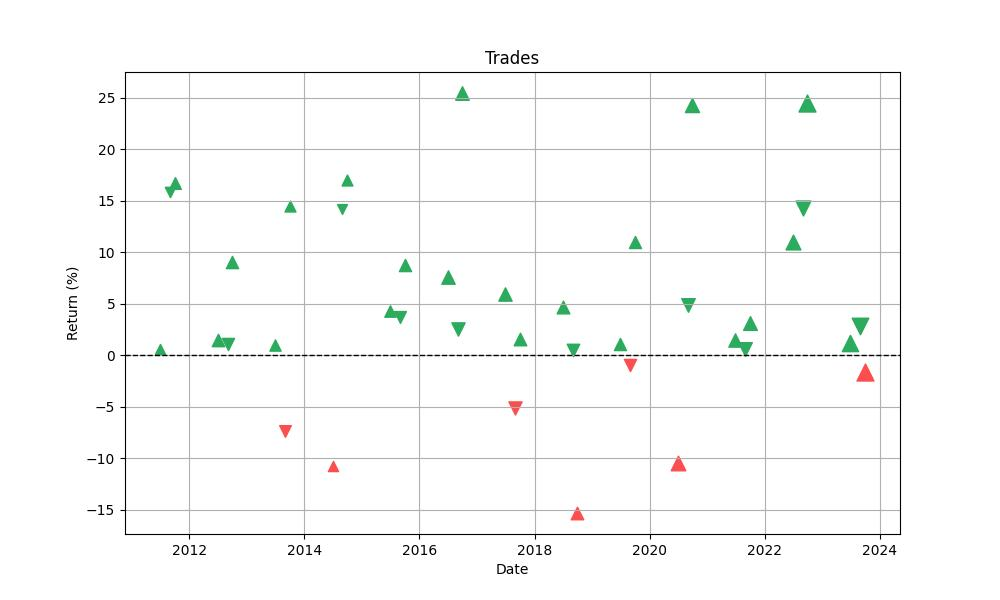

When it comes to trading strategies, the devil is often in the details. In the case of Air Lease Corporation (AL), a monthly seasonality strategy was put to the test, and the results are quite revealing. Over the course of 39 trades, this strategy has demonstrated an impressive win rate of approximately 82.05%. In the trading world, where uncertainty is the only certainty, a strategy with such a high win rate is like finding a diamond in the rough.

Diving a bit deeper, we find that the best trade within this strategy yielded a remarkable 25.47% return. This level of gain is not only significant but also suggests that when the strategy works, it has the potential to work exceptionally well. On the flip side, even the most robust strategies have their downfalls, and this one is no exception. The worst trade recorded a loss of 15.30%, a reminder that risk is an inherent part of stock market investing.

However, the average trade tells a story of consistent performance, with an average gain of 4.87%. This figure is important because it gives a more balanced view of what a typical trade might look like, rather than being skewed by outliers. Investors might find comfort in knowing that while not every trade can be the best, the average still points to a favorable outcome.

The duration of trades in this strategy is also worth noting. The longest trade lasted 63 days, while on average, trades were held for 41 days. This reflects a moderate holding period that aligns well with the monthly seasonality approach. It indicates that the strategy doesn’t require investors to tie up capital for excessively long periods, potentially allowing for greater flexibility in their overall investment approach.

What truly stands out is the Profit Factor, which sits at a robust 5.00. The Profit Factor is a measure of the strategy’s profitability, calculated by dividing the total gains of the winning trades by the total losses of the losing trades. A Profit Factor greater than one indicates a profitable strategy, and at 5.00, the signal here is that for every dollar lost, five were gained — a ratio that would make any investor sit up and take notice.

Finally, the Expectancy of 5.28% provides additional insight into the strategy’s effectiveness. Expectancy gives us an estimated average return per trade, factoring in both wins and losses. In this context, an expectancy of over 5% suggests that each trade, on average, contributes positively to the growth of the investment portfolio.

Conclusion

As we wrap up our exploration of the seasonal trading strategy for Air Lease Corporation (AL), the compelling evidence suggests that timing, when paired with disciplined execution, can indeed be a powerful ally in the world of stock trading. The impressive growth from an initial $10,000 investment to over $63,000, alongside robust annualized returns and a high win rate, exemplifies the potential of a well-researched seasonality strategy.

Beyond the attractive returns, the strategy’s reduced volatility and lower drawdowns compared to a passive buy-and-hold approach underline the importance of risk management in achieving long-term success. The quicker recovery from drawdowns and the strategy’s ability to generate higher risk-adjusted returns further bolster the case for considering seasonality as a core component of a trading strategy.

The trade analysis reveals consistency and profitability, with an average gain that speaks to the strategy’s reliability, and a Profit Factor that confidently asserts the strategy’s effectiveness. These metrics, coupled with the high expectancy per trade, provide a clear indication that the strategy is not just a matter of chance, but the result of a well-calibrated approach to seasonal market trends.

In conclusion, the deep dive into this monthly seasonality strategy provides a blueprint for how investors might leverage historical patterns to their advantage. It is a testament to the potential of marrying data-driven insights with a meticulous trading regimen. While past performance is not indicative of future results, the demonstrated efficacy of this strategy offers a promising perspective for those willing to embrace the rhythm of seasonality in their investment pursuits. As with any investment strategy, individual investors should consider their own risk tolerance and investment objectives, but the evidence presented here certainly makes a compelling case for the inclusion of seasonality in a diversified trading arsenal.

“Make the invisible visible. My goal is to shine a light on the subtle seasonal signals in the stock market, providing investors with the insight needed to make informed decisions. By breaking down the complexities of seasonality, I strive to empower our audience with knowledge and foresight, turning data into action.”