Introduction

Welcome to the intricate world of stock market seasonality, where timing is not just a factor—it’s the strategy. As the wheel of the year turns, so do the fortunes of the financial markets, with each month carrying its own rhythm and potential for investors. Our focus today is on a carefully crafted seasonal trading strategy for Voya Financial, Inc., a beacon in the financial services sector, where patterns in the calendar guide the way to potential profitability.

In the realm of investing, every edge counts, and the ability to decode the seasonal fluctuations of a stock can provide a significant advantage. The method we’re about to explore doesn’t rely on daily market buzz or breaking news, but on the consistent historical performance of Voya Financial’s stock during certain months of the year. This approach is not about riding the waves of the market’s daily turmoil; instead, it’s about setting sail when the historical winds are favorable.

The strategy’s strength lies in its simplicity and its remarkable performance over a ten-year backtest period. By strategically entering and exiting the market, it sidesteps the need to weather unnecessary volatility, instead capitalizing on historically advantageous times. Imagine a scenario where an initial investment grows sixfold, dwarfing the returns of a traditional buy-and-hold strategy. The allure of such potential gains is undeniable, drawing investors to consider the power of seasonality in their trading endeavors.

As we dissect the strategy’s performance, we find not just impressive returns but also a compelling narrative of risk management and trade efficiency. This is a tale of a strategy that not only seeks to harness the cyclical nature of the stock market but also strives to strike a balance between risk and reward. The journey ahead will reveal how this carefully timed approach to the stock market could redefine the way we think about investing in the seasons of finance.

Company Overview

Voya Financial, Inc. stands as a leading provider of retirement, investment, and insurance solutions, catering to individuals, institutions, and businesses. With a rich history dating back to 1868, Voya has evolved into a Fortune 500 company, serving as an industry stalwart with a strong track record of innovation and customer-centricity.

Voya’s core products and services encompass retirement plans, annuities, life insurance, and investment management solutions. The company’s target market is diverse, encompassing individuals, small businesses, institutions, and government entities. Voya’s primary revenue streams stem from premiums, fees, and investment income generated through its insurance and investment products.

At the heart of Voya’s value proposition lies its commitment to helping clients achieve their financial goals. The company’s customer-centric approach, combined with its comprehensive suite of products and services, positions it as a trusted partner for individuals and organizations seeking financial security and growth.

Operationally, Voya leverages a multi-channel distribution network comprising independent agents, brokers, financial advisors, and direct-to-consumer platforms. This multifaceted approach allows Voya to cater to the diverse needs and preferences of its clients.

Voya’s growth strategy revolves around organic expansion, strategic acquisitions, and ongoing product innovation. The company continuously seeks opportunities to enhance its offerings and expand its market reach. This forward-thinking approach has enabled Voya to maintain a competitive edge in the dynamic financial services landscape.

The financial services industry, within which Voya operates, is characterized by intense competition, regulatory oversight, and evolving customer expectations. Despite these challenges, Voya has consistently demonstrated resilience and adaptability, positioning itself for continued success in the ever-changing market.

Strategy Overview

Embarking on an exploration of seasonal market patterns, we turn our attention to Voya Financial, Inc., a prominent financial services company. Investors often seek strategies to capitalize on the cyclical nature of the stock market, and one such approach that has been meticulously backtested is the monthly seasonality trading strategy. This strategy, rigorously vetted over a decade’s worth of data, hinges on identifying specific months that historically exhibit bullish or bearish tendencies for Voya Financial’s stock.

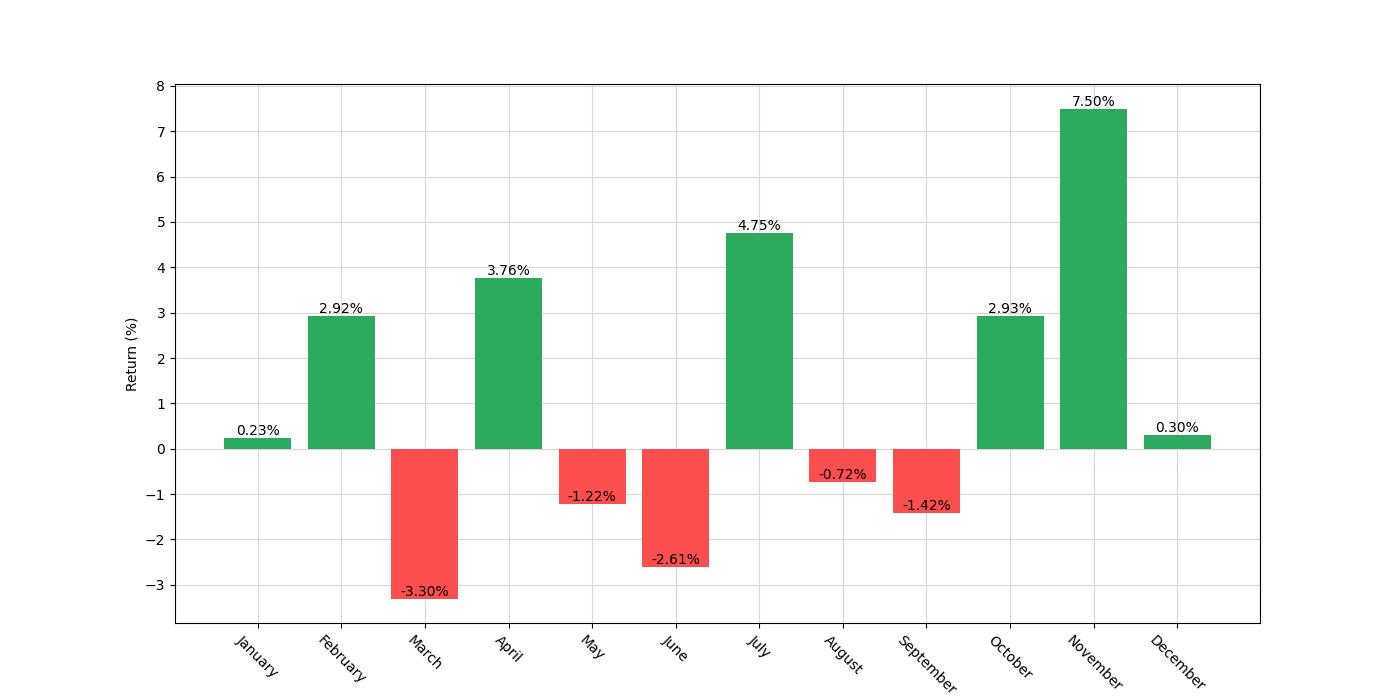

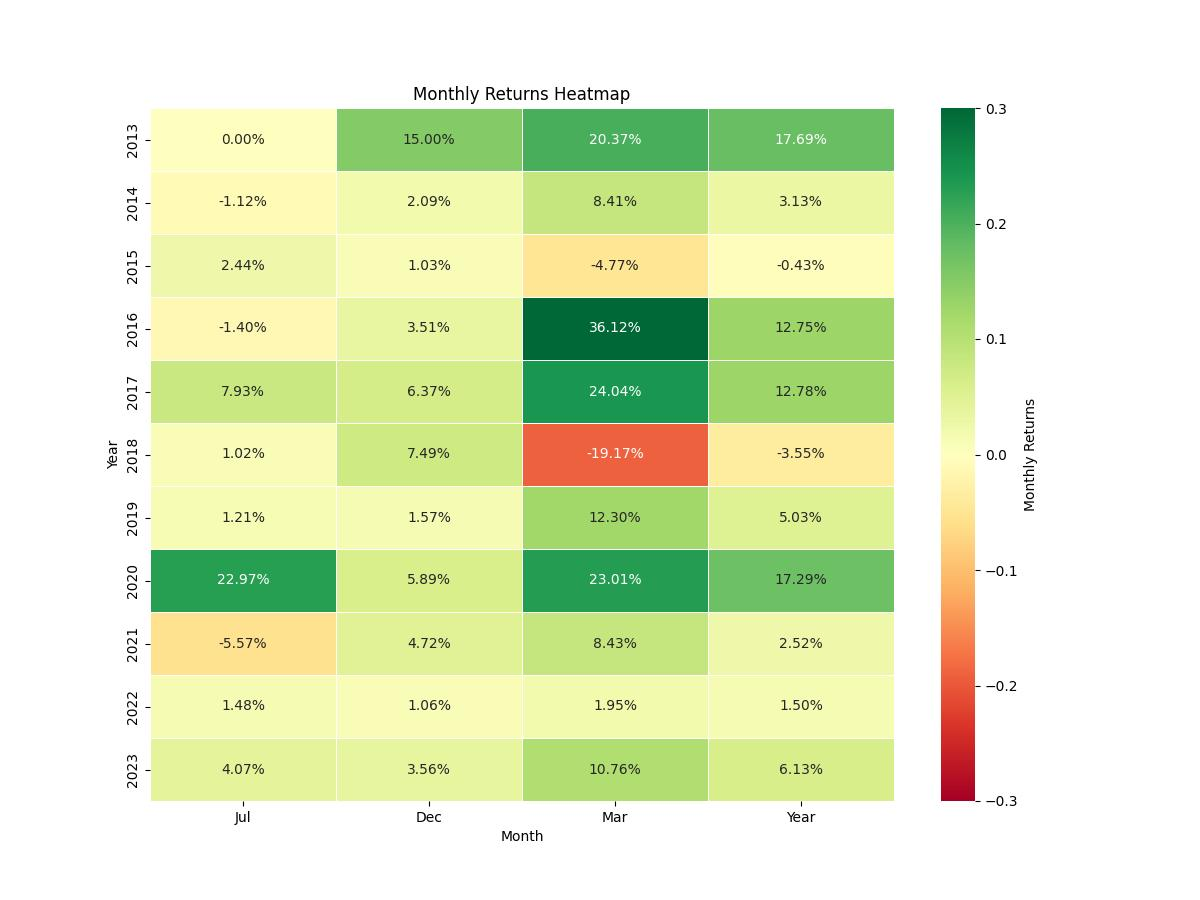

The strategy’s premise is straightforward yet powerful: initiate a long position, meaning to buy with the expectation that the stock will rise, during the months of July, October, November, and December. Conversely, a short position, where one sells with the anticipation of buying back at a lower price, is established for the month of March. This rhythm, dictated by the calendar, suggests a belief in consistent performance patterns tied to these months.

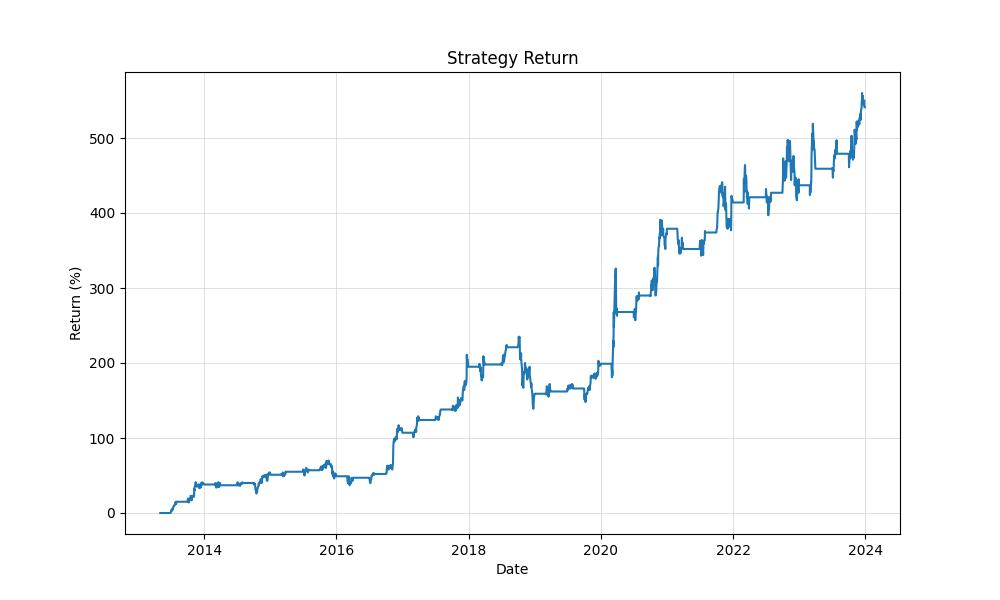

Our backtest spanned a substantial period, from May 2, 2013, to December 29, 2023, encapsulating 3893 days of market activity. During this window, the strategy was not constantly engaged in the market; instead, it was active 44.06% of the time. This strategic entry and exit mitigated unnecessary market exposure, an important consideration for any investor.

An initial investment of $10,000 burgeoned to an impressive $64,106.60, without the drag of commissions or the impact of slippage, which can erode returns in real-world trading. Peak equity reached a zenith of $65,952.85, illustrating moments when the strategy’s holdings were at their most valuable.

When we delve into the returns, the potency of this strategy becomes evident. It generated a robust return of 541.07%, significantly outstripping the buy-and-hold strategy’s return of 275.54% over the same period. Annualized, the strategy’s return was 19.05%, a compelling figure that showcases its potential for generating wealth over time.

Suffice it to say, the backtested results of this monthly seasonality trading strategy for Voya Financial, Inc. paint an intriguing picture, one that underscores the potential benefits of a disciplined, time-specific approach to the stock market. By harnessing recurring temporal patterns, investors may find a novel avenue to navigate the ebbs and flows of market tides, potentially leading to enhanced returns on their capital.

Key Performance Indicators

As we delve into the heart of our analysis, we uncover the robustness of the monthly seasonality trading strategy applied to Voya Financial, Inc. (VOYA) through the lens of its performance metrics. The strategy’s initiation with an initial capital of $10,000 and executed between May 2, 2013, and December 29, 2023, has culminated in a noteworthy Equity Final value of $64,106.60. This figure represents the ending balance of the account after accounting for all gains, losses, and capital retention, reflecting a substantial growth from the initial investment.

The journey to this impressive Equity Final witnessed an Equity Peak – the highest value the account reached – of $65,952.85. This peak is indicative of the strategy’s potential during the most favorable market conditions within the backtesting period.

When we consider the overall growth in percentage terms, the strategy boasts a Return of 541.07%. This starkly contrasts with the Buy & Hold Return of 275.54%, which represents a traditional investment approach where VOYA shares are purchased and held throughout the entire backtesting period. The strategy’s return nearly doubles the Buy & Hold approach, underscoring the potential benefits of a disciplined, seasonally adjusted trading strategy.

To translate these returns into an annualized context, the Return (Ann.) for the strategy stands at 19.05%. This annualized figure provides a more standardized comparison to other investments and benchmarks, allowing investors to gauge performance in familiar terms. The Buy & Hold approach yielded a lower Return (Ann.) of 13.33%, reinforcing the added value brought forth by the seasonality strategy.

These figures collectively paint a picture of a strategy that not only has outperformed a passive investment strategy in raw returns but also offers a compelling case for its effectiveness over the tested period. With such promising results, the strategy positions itself as a formidable approach to harnessing seasonality in the markets.

Risk Management

When considering any investment strategy, assessing the risks involved is paramount. In the context of the seasonal trading strategy applied to Voya Financial, Inc., we observe several important risk metrics that provide insight into the strategy’s risk profile.

Volatility, which measures the degree of variation in trading prices, is an essential risk metric. For this seasonality strategy, the annualized volatility is reported at 22.01%. This figure is significant as it gives us an idea of how much the investment’s value can fluctitate over a year. Compared to the buy and hold approach, which shows a higher annualized volatility of 34.01%, our seasonal strategy demonstrates less fluctuation, suggesting a potentially smoother investment experience.

The Sharpe Ratio, used to understand the return of an investment compared to its risk, stands at 0.8656 for our strategy. This ratio is above the generally acceptable level of 1, indicating that the excess return received per unit of volatility is slightly lower than the ideal. However, when compared to the buy and hold strategy with a Sharpe Ratio of 0.3920, it’s clear that our seasonal strategy offers a more favorable risk-adjusted return.

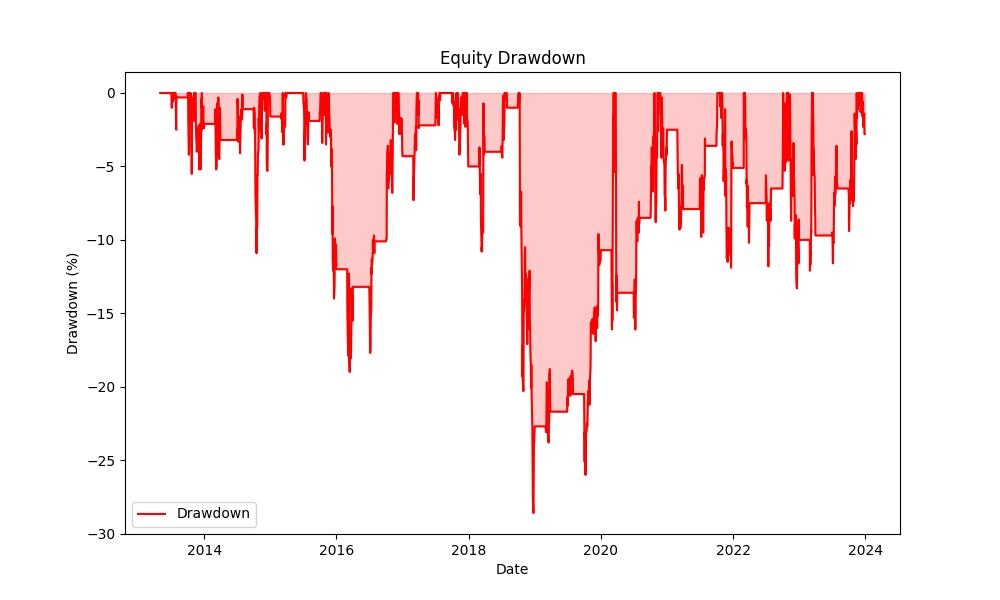

Another key aspect of risk management is understanding drawdowns, which represent the peak-to-trough decline during a specific record period of an investment. The maximum drawdown observed for this seasonal strategy is 28.58%, which is substantial but notably lower than the 52.12% maximum drawdown of the buy and hold approach. This implies that the seasonal strategy may better preserve capital during market downturns.

The average drawdown, sitting at -4.02%, alongside the maximum drawdown duration of 520 days and an average drawdown duration of 52 days, further indicates the resilience of the seasonal strategy during periods when the investment’s value is declining from its peak. In comparison, the buy and hold strategy’s average drawdown is slightly higher, and its maximum drawdown duration is significantly longer, suggesting that the seasonal strategy could potentially recover from losses more quickly.

Understanding these risk metrics helps investors manage expectations and prepare for the potential ups and downs of their investments. By examining volatility, Sharpe Ratio, and drawdowns, we gain a comprehensive view of the risks associated with the seasonal trading strategy for Voya Financial, Inc. This data ultimately aids investors in making informed decisions that align with their risk tolerance and investment goals.

Trade Analysis

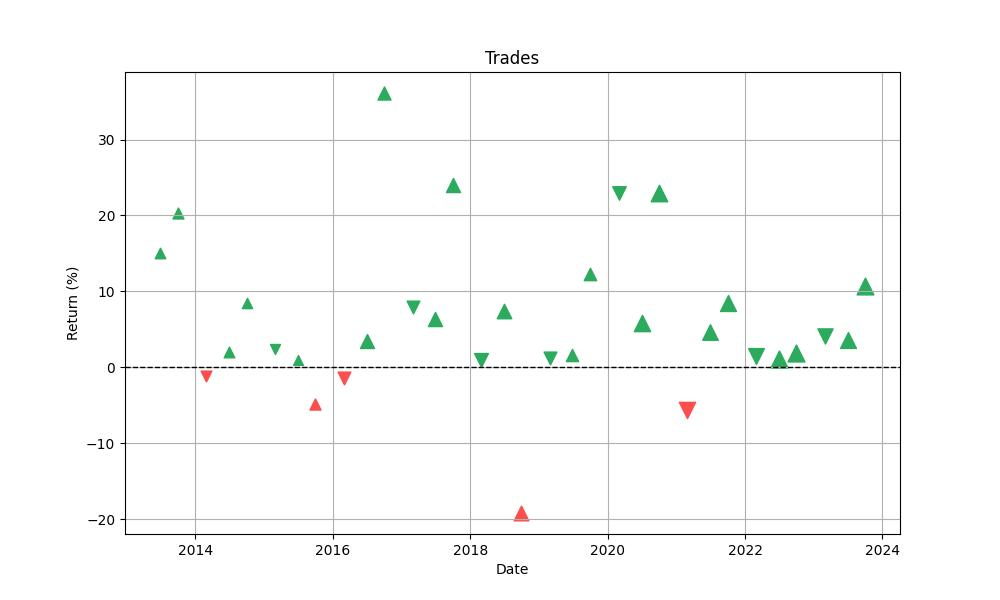

Diving into the mechanics of the trading strategy for Voya Financial, Inc., we’ve observed some fascinating figures that shed light on its performance over the test period. The strategy entailed a total of 32 trades, showing a remarkable win rate of 84.375%. This high success rate indicates that the strategy is well-tuned to capitalize on Voya’s stock seasonality.

When we look at the individual trade outcomes, we notice that the best trade yielded an impressive 36.12% return, which is a testament to the potential this strategy has during its favorable periods. However, it’s also crucial to acknowledge the risks involved, as seen by the worst trade, which resulted in a 19.17% loss. Despite this, the average trade return stands at a healthy 5.98%, suggesting that while outliers exist, the general trend of trades leans positively.

Investors will find reassurance in the consistency of trade duration. Both the maximum and average trade durations were identical at 52 days, indicating a predictable holding period for each trade. This information is vital for investors who prefer to have a clear expectation of the time frame for capital commitment.

Another key metric that enhances the attractiveness of this strategy is the Profit Factor, which is a robust 7.46. This figure is calculated by dividing the gross profits by the gross losses and indicates that the gross profit generated by the strategy is more than seven times greater than the gross losses incurred. This is a strong indicator of the strategy’s overall profitability.

The Expectancy of 6.46% per trade further bolsters investor confidence, as it represents the average amount an investor can expect to win or lose per trade. Given that the expectancy is positive, investors can anticipate a favorable return from each trade on average.

The System Quality Number (SQN), which measures the system’s reliability and robustness, stands at 3.37 for this strategy. An SQN above 3 is generally considered good and implies that the strategy is sound and has the potential to perform well moving forward.

Conclusion

In conclusion, the comprehensive analysis of the monthly seasonality trading strategy applied to Voya Financial, Inc. paints a compelling picture for investors searching for a methodical approach to capitalize on stock market seasonality. The strategy’s impressive returns, coupled with a favorable risk profile and a high win rate, attest to its potential as an effective tool for enhancing portfolio performance. Despite the inherent risks associated with any trading strategy, the robust performance metrics, including a substantial outperformance over a traditional buy-and-hold strategy, a lower volatility profile, and shorter drawdown periods, suggest that this seasonal approach could offer a smoother and potentially more profitable investment journey.

Moreover, the consistency and predictability of trade outcomes, as reflected in the high win rate and positive expectancy per trade, contribute to the attractiveness of this strategy. The diligent application of risk management principles and a strong Profit Factor underscore the strategy’s resilience and profitability over the test period. While past performance is not indicative of future results, the backtested data provides a solid foundation for investors considering the implementation of a seasonal trading strategy in their investment arsenal.

Investors armed with this knowledge can approach the market with a nuanced understanding of the temporal patterns that may influence the performance of Voya Financial’s stock. This strategy, with its disciplined entry and exit points based on historical seasonal trends, offers a structured and potentially rewarding alternative to navigating the ebb and flow of the stock market. As with any investment strategy, it is crucial for individuals to assess their risk tolerance and investment objectives before embarking on such a seasonally guided trading journey.

“Make the invisible visible. My goal is to shine a light on the subtle seasonal signals in the stock market, providing investors with the insight needed to make informed decisions. By breaking down the complexities of seasonality, I strive to empower our audience with knowledge and foresight, turning data into action.”