Introduction

As the leaves change colors and the air grows crisp with the onset of autumn, seasoned investors know that change isn’t just confined to nature—it’s also a constant in the bustling world of the stock market. Yet, amidst this ever-shifting financial landscape, certain cyclical patterns persist, offering a beacon for strategic trading that can turn the inevitable tides of time into a source of opportunity. Seasonality in the stock market, a phenomenon as intriguing as it is influential, captures the essence of these recurring trends and forms the basis for trading strategies that seek to harness the rhythmic pulse of the market’s temporal heartbeat.

Imagine a world where the calendar itself could signal the ebbs and flows of market fortunes—a world where certain months could whisper the secrets of impending bullish enthusiasm or caution against the bear’s impending growl. This is the world of seasonal stock market strategies, where time itself becomes an ally to the astute investor. In this introduction, we’ll embark on a journey through the intricacies of such a strategy, applied with precision to the vibrant stock of HubSpot, Inc.—a company at the forefront of digital marketing innovation. We’ll explore how a well-crafted approach, tuned to the unique cadence of specific months, can lead to extraordinary outcomes. Join me as we unravel the tapestry of temporal market trends, and uncover the potential that lies in aligning one’s investment rhythm with the market’s seasonal dance.

Company Overview

HubSpot, Inc. is a leading provider of customer relationship management (CRM) software and services, empowering businesses to grow better. Its comprehensive CRM platform includes marketing, sales, service, and operations tools that help businesses connect with customers, convert leads to sales, provide exceptional customer service, and streamline operations. HubSpot primarily targets small and medium-sized businesses (SMB) but also offers enterprise-level solutions. Revenue streams include subscriptions to its CRM platform, professional services, training and certifications, and a marketplace for third-party integrations. HubSpot’s value proposition lies in its ease of use, affordability, and all-in-one approach, making it a popular choice for businesses seeking an integrated solution to manage their customer relationships. The company follows a freemium business model, offering a basic version of its CRM platform for free to attract customers and upselling additional features and services. HubSpot’s growth strategy involves continuous product innovation, expanding its partner ecosystem, and venturing into new markets. The CRM industry is highly competitive, with established players like Salesforce and Microsoft Dynamics 365. However, HubSpot’s focus on SMBs and its ability to adapt to changing market dynamics position it for continued success.

Strategy Overview

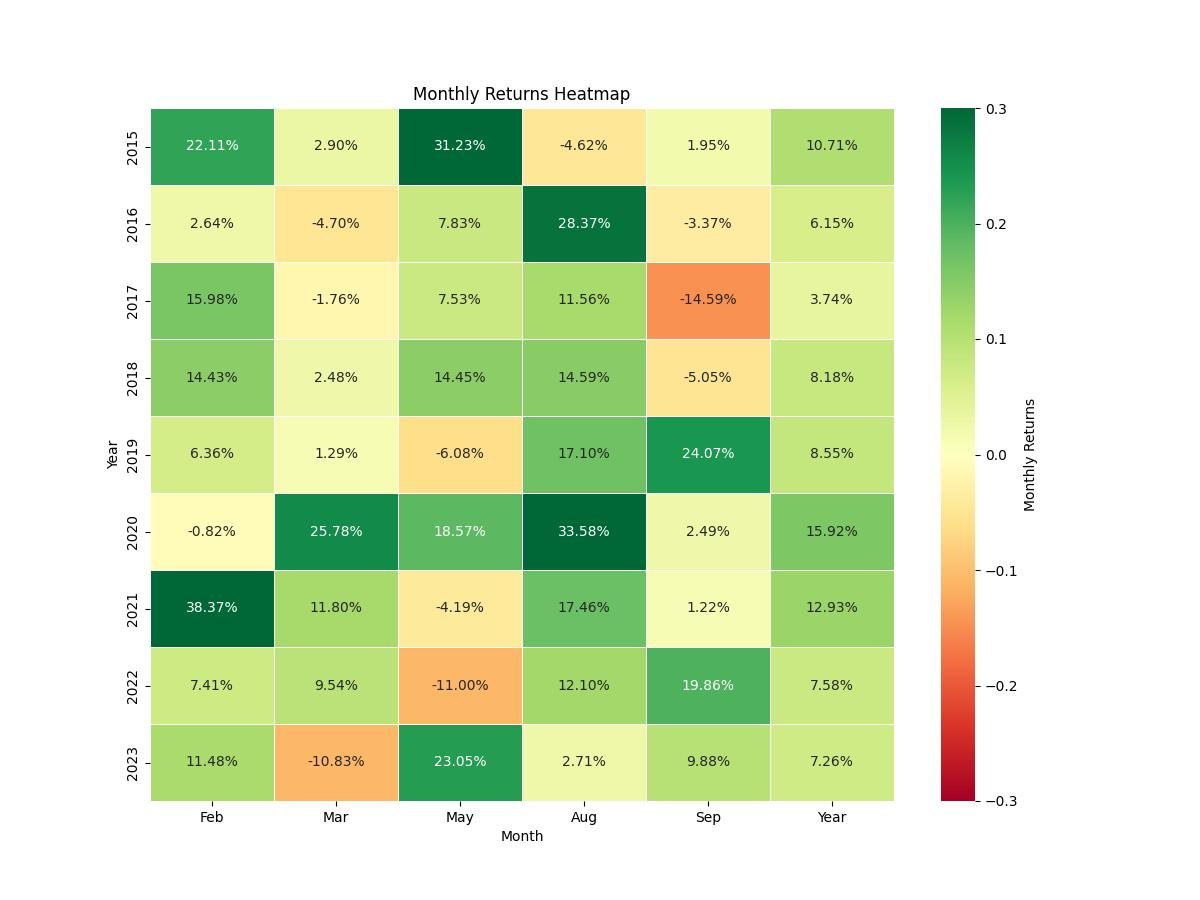

Understanding the seasonality of the stock market can lead to insightful trading strategies that aim to capitalize on predictable patterns associated with specific times of the year. One such approach is a monthly seasonality trading strategy, which has been applied to HubSpot, Inc. (Symbol: HUBS), a contemporary company known for its inbound marketing, sales, and service software products.

The backtest of this strategy spans an extensive period, starting from October 9, 2014, and culminating on December 29, 2023, covering a total of 3368 days—or a little over nine years. During this time, the rules of engagement were straightforward: initiate a long position (buy) at the close of the last trading day of the preceding month and sell at the close of the last trading day for the months of January, February, May, July, and August. Conversely, a short position (sell) was established for March and September following the same close-to-close principle.

An initial capital amount of $10,000 was the basis for the strategy, and throughout the testing period, the investment was exposed to the market for roughly half of the time, at 50.04%. This exposure percentage is significant because it implies that the strategy does not keep the capital constantly at risk in the market—potentially a prudent move for risk-averse investors.

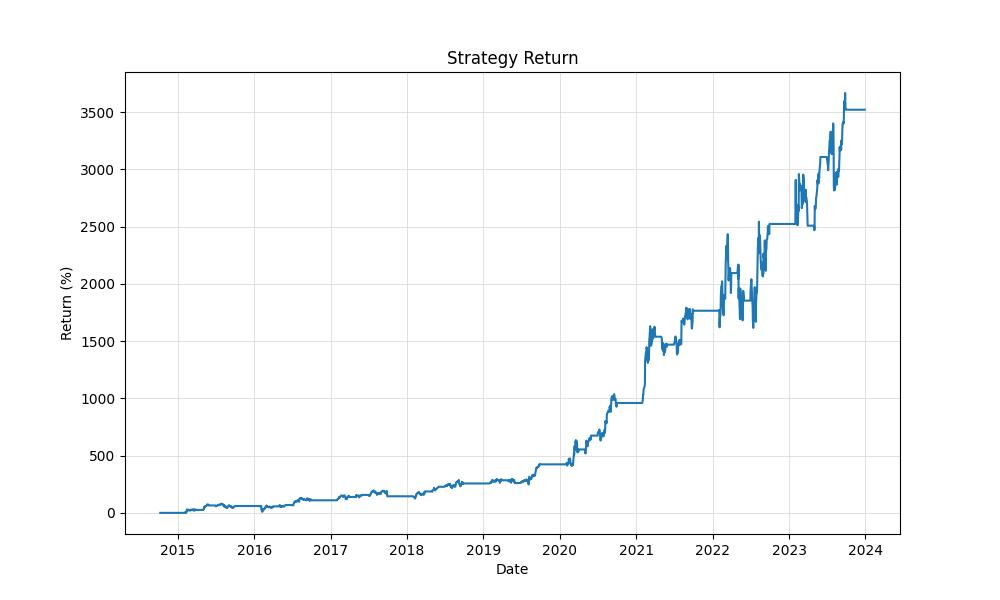

The outcome of this approach is rather impressive, with the final equity amounting to $362,204.50. The strategy’s equity peaked even higher at $376,833.28, indicative of the strategy’s potential when market conditions align favorably. In terms of returns, the strategy yielded a staggering 3522.05% over the backtest period. This figure outperforms the buy & hold strategy’s return of 1828.70% for the same period, which suggests that the seasonality strategy adeptly capitalized on market patterns that the passive approach could not.

It’s also worth noting that the annualized return for the seasonality strategy stands at 47.63%, a robust figure that highlights the strategy’s effectiveness over time. The buy & hold approach, while still impressive, delivered a lower annualized return of 38.62%.

The strategy’s performance, defined by the outlined trading rules and the backtest period, indicates that a methodical application of seasonal trends in the stock market can indeed yield substantial gains. By focusing on specific months where historical patterns have suggested a higher probability of favorable market movements for HubSpot, the strategy aims to maximize profits while reducing the time during which the capital is exposed to market fluctuations. The results of this backtest provide a compelling case for investors interested in seasonal trading strategies and underscore the potential benefits of a well-researched and disciplined approach to stock market investing.

Key Performance Indicators

Investors often gauge the success of a trading strategy by looking at its returns, but seasoned market players know that the full story is told through a suite of performance indicators. In the case of the monthly seasonality trading strategy applied to HubSpot, Inc., a deeper analysis reveals a fascinating narrative of growth and efficiency.

The final equity value reached by employing the seasonality strategy is a robust $362,204.50, a striking figure when you consider the starting capital was $10,000. This performance towers over the equity peak, which touched $376,833.28 at its zenith. To put these numbers into perspective, the strategy’s total return amounted to an extraordinary 3522.045%, dwarfing the 1828.70% return of a simple buy-and-hold approach for the same period. This stark contrast not only highlights the strength of the strategy but also underscores the potential of tactical seasonal investing.

When we annualize these returns, the strategy continues to impress with a 47.63% annualized return, a testament to its consistency and potential as a long-term investment approach. It’s particularly noteworthy when compared to the annualized return of the buy-and-hold method, which stands at 38.62%. The higher annualized return from the seasonal strategy suggests a more efficient use of capital over time, which is essential for investors looking to maximize growth.

Understanding these numbers within the broader context of market performance provides a clear indication that the seasonal trading strategy not only capitalized on the inherent fluctuations of HubSpot, Inc.’s stock but did so with remarkable effectiveness. These are the kinds of results that can make a significant impact on an investor’s portfolio, showcasing the power of a well-researched and rigorously tested trading strategy grounded in the seasonality of the markets.

Risk Management

Understanding the risk profile of a trading strategy is paramount for investors who wish to balance potential returns against the likelihood of adverse outcomes. In the backtested results for the monthly seasonality trading strategy applied to HubSpot, Inc., several indicators provide insight into the risk management of this investment approach.

The annualized volatility, which measures the extent of the strategy’s fluctuations over a year, stands at 53.64%. This figure indicates a relatively high level of variability in the returns generated by the strategy. A higher volatility often suggests more uncertainty and risk, as the value of the investment can change significantly in a short period.

Despite the notable volatility, the Sharpe Ratio, a tool used to evaluate the risk-adjusted return of an investment, is 0.888. This is below the ideal benchmark of 1 but still points to a reasonable balance between the excess return earned over the risk-free rate and the additional risk taken on by the strategy. In this context, the strategy has provided sufficient returns to justify the volatility experienced.

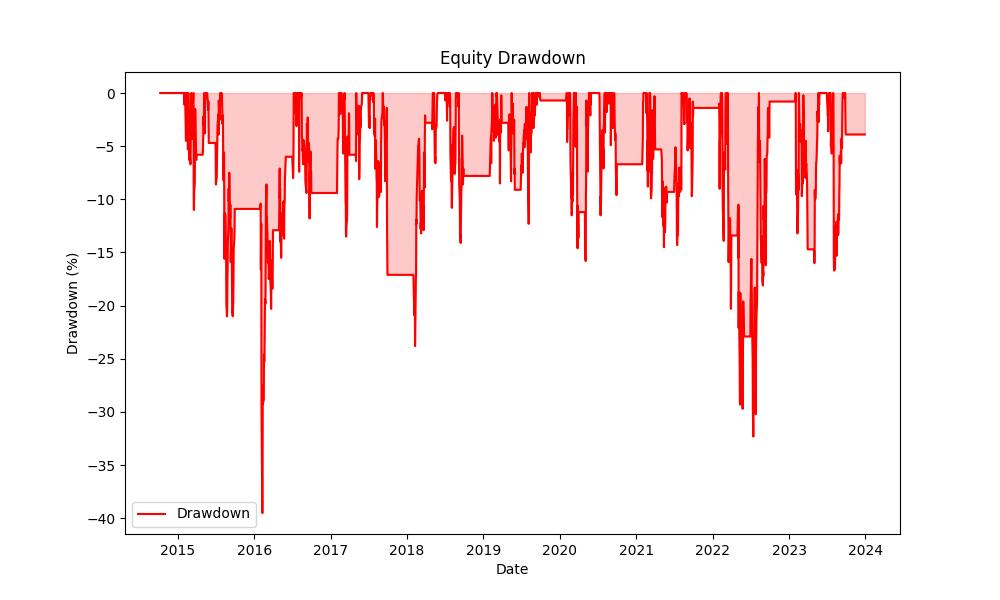

A critical aspect of risk assessment is the strategy’s Maximum Drawdown, which indicates the largest peak-to-trough decline in the account’s value. At -39.54%, the drawdown is significant, suggesting that the strategy could experience substantial temporary losses, which investors must be prepared to withstand. It is important to note, however, that the Average Drawdown is considerably lower at -5.75%, implying that typical drawdowns are much less severe.

The duration of these drawdowns is also telling. The Maximum Drawdown Duration is 345 days, which means investors might have to endure a lengthy period before the strategy recovers from its most substantial loss. Conversely, the Average Drawdown Duration is only 35 days, indicating that while the most significant losses can take time to recover, more common drawdowns tend to be relatively short-lived.

These risk metrics are not only essential in understanding the potential downsides of the strategy but also in comparing it to a simple buy-and-hold approach. For instance, the buy-and-hold strategy for HubSpot, Inc. shares over the same period presented a substantially higher Maximum Drawdown of approximately -69.94%, suggesting that the monthly seasonality strategy offers a more palatable risk profile for loss-averse investors.

In sum, while the monthly seasonality trading strategy for HubSpot, Inc. demonstrates commendable returns, these must be weighed against the associated risks. It exhibits a high level of return volatility, a significant maximum drawdown, and a drawdown duration that could test an investor’s resolve. However, compared to a passive investment strategy, it offers a more favorable risk-adjusted performance, which might be attractive to investors seeking to optimize their portfolios for long-term growth while managing downside risk.

Trade Analysis

In the realm of trading, the numbers often speak louder than words. Yet, it is the story behind these numbers that offers investors the insights they need to navigate the stock market with confidence. Let’s delve into the statistics of our monthly seasonality trading strategy as applied to HubSpot, Inc. (HUBS), drawing out the nuanced narrative they present.

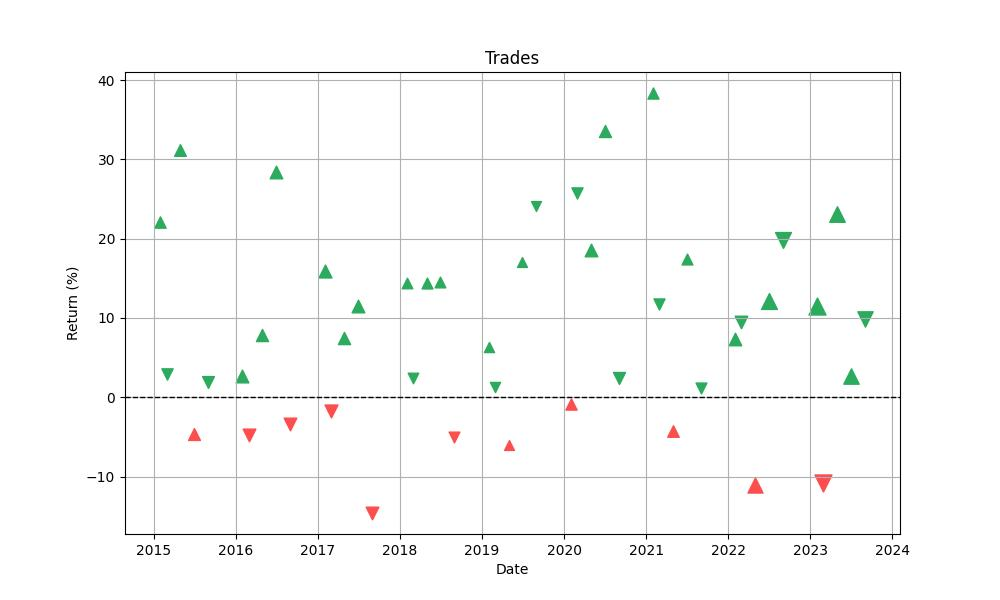

Over the course of our backtesting period, the strategy executed a total of 45 trades. The frequency of these trades reflects a disciplined adherence to the seasonal parameters we set, ensuring that the strategy was active only when it was designed to be. It’s worth noting that out of these trades, 75.56% were profitable. This win rate is a testament to the robustness of the strategy, highlighting its effectiveness in predicting and capitalizing on HubSpot’s stock performance during the specified months.

The individual trade outcomes reveal further layers to the strategy’s performance. The best trade generated an impressive 38.37% return, showcasing the potential for significant gains when the strategy’s signals align with favorable market conditions. On the flip side, the strategy’s resilience is illustrated by its worst trade, which resulted in a manageable 14.59% loss, suggesting that even when the market moves against the strategy, the impact is contained and does not derail the overall profitability.

The average trade yielded an 8.32% return, which is an encouraging figure when considering the investment returns across various asset classes. It underscores the strategy’s capacity to deliver substantial results on a consistent basis. Moreover, the maximum trade duration was 63 days, and the average trade duration was 37 days, indicating that the strategy does not overstay its welcome in the market. This aspect of the strategy aligns with the principle of capturing seasonal trends without being unduly exposed to market risks outside of these periods.

A crucial measure of a trading strategy’s performance is its profit factor, which in this case stands at a remarkable 7.05. This ratio of gross profits to gross losses signifies that for every dollar lost, the strategy earned seven dollars in profit, painting a picture of a highly efficient trading approach. The expectancy of 9.00% further bolsters this impression, as it represents the average amount the strategy can expect to win or lose per trade. With a positive expectancy, traders can look forward to potential gains over the long term.

Lastly, the System Quality Number (SQN), which measures the system’s reliability and psychological comfort for the trader, came in at 3.24. This robust score reflects not only the strategy’s profitability but also its consistency and stability, factors that are crucial for investors who seek a systematic approach to growing their capital.

In dissecting these trade-related metrics, we unveil a strategy that has demonstrated the capability to not only identify opportune times for entering and exiting trades within the market’s seasonal ebbs and flows but also to manage risks effectively while striving for consistent profitability. For retail investors, these insights offer a glimpse into the mechanics of a trading strategy that is grounded in the analysis of seasonal trends, providing a structured yet dynamic way to engage with the stock market.

Conclusion

In conclusion, the monthly seasonality trading strategy for HubSpot, Inc. has proven to be a formidable approach to stock market investment, yielding impressive results over a nine-year backtest period. Our analysis reveals a strategy that not only outperforms the passive buy-and-hold method but does so with a calculated exposure to market risks. The substantial final equity value, coupled with the high annualized return, offers a compelling narrative of what disciplined and strategic seasonal trading can achieve.

However, the journey to these remarkable returns is not without its risks. A relatively high volatility and a significant maximum drawdown remind us that while the rewards can be great, they come at the cost of enduring potential fluctuations and downturns. Yet, when compared to the passive approach, the monthly seasonality strategy offers a more attractive risk-adjusted performance profile, which might resonate with investors who are particularly risk-conscious.

By striking a balance between the pursuit of high returns and the management of associated risks, this strategy exemplifies how a well-researched and carefully implemented seasonal trading plan can lead to outsized gains in the stock market. For investors seeking to refine their portfolios with time-tested strategies, the insights gleaned from this backtest provide a blueprint for leveraging seasonal trends to optimize long-term investment outcomes. As with any trading strategy, investors are encouraged to consider their own risk tolerance and investment objectives, but the data presented here underscores the potential of incorporating seasonality into a diversified trading strategy.

“Make the invisible visible. My goal is to shine a light on the subtle seasonal signals in the stock market, providing investors with the insight needed to make informed decisions. By breaking down the complexities of seasonality, I strive to empower our audience with knowledge and foresight, turning data into action.”