Introduction

As seasons change, so too can the fortunes of the stock market, presenting unique opportunities for the savvy investor. The notion that stock prices might follow a seasonal pattern is more than an old market adage—it is a concept that can be tested, refined, and potentially exploited for financial gain. This is the premise behind seasonal trading strategies, which seek to capitalize on predictable temporal patterns in stock prices to outperform more traditional investment strategies.

In this article, we delve into the intriguing world of seasonal stock market strategies, focusing on the case of Citizens Financial Group, Inc. (CFG). We will take you through an empirical journey, examining the backtested performance of a strategy that plays the rhythmic dance of CFG’s stock prices with the calendar’s turn. We’ll explore how such a strategy, by selectively engaging with the market during historically advantageous months, could have led to impressive returns that far exceed those of a passive buy-and-hold approach.

Join us as we dissect the components of this seasonal trading strategy, from its conception to its execution, and evaluate its performance against rigorous metrics. Our analysis is designed to equip investors with the insights necessary to understand the potential benefits and risks of timing the market based on historical patterns. Whether you’re a seasoned trader or a curious newcomer, the following exploration of CFG’s market seasonality offers a fascinating glimpse into the intersection of time and finance.

Company Overview

Citizens Financial Group, Inc. (CFG), a leading regional financial services company, has a rich history of providing financial solutions to individuals, businesses, and organizations for over 200 years. With a strong focus on relationship banking, CFG offers a diverse range of products and services, including consumer and commercial banking, mortgage lending, investment, and trust services.

Catering primarily to retail and commercial customers in the Northeast, Midwest, and Sunbelt regions, CFG generates revenue through net interest income, non-interest income, and other income sources. The company’s value proposition lies in its personalized approach, tailored financial advice, and digital banking capabilities.

CFG’s operational model emphasizes customer-centricity, leveraging technology to enhance convenience and efficiency. It also maintains a solid risk management framework to mitigate financial and operational risks. The growth strategy involves expanding into new markets, enhancing digital offerings, and optimizing operational efficiency.

The banking industry, in which CFG operates, is highly competitive, characterized by evolving regulations, technological advancements, and changing consumer preferences. Despite these challenges, CFG’s strong brand recognition, diversified revenue streams, and commitment to customer service position it well for continued success.

Strategy Overview

In the realm of stock market investing, one approach that has piqued the interest of many is the practice of aligning trades with the rhythmic pattern of the calendar. This is precisely what we’ve explored with Citizens Financial Group, Inc. (CFG), where we’ve conducted a meticulous backtest to understand how a monthly seasonality trading strategy would have performed historically.

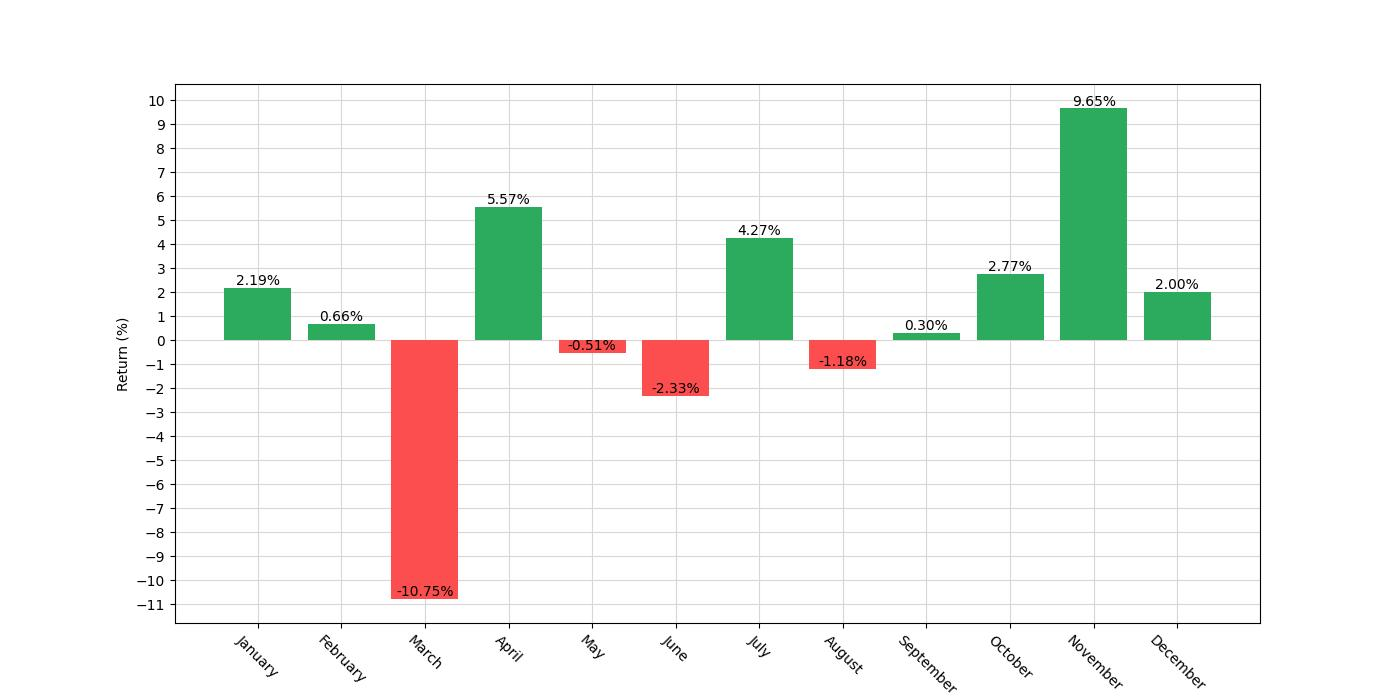

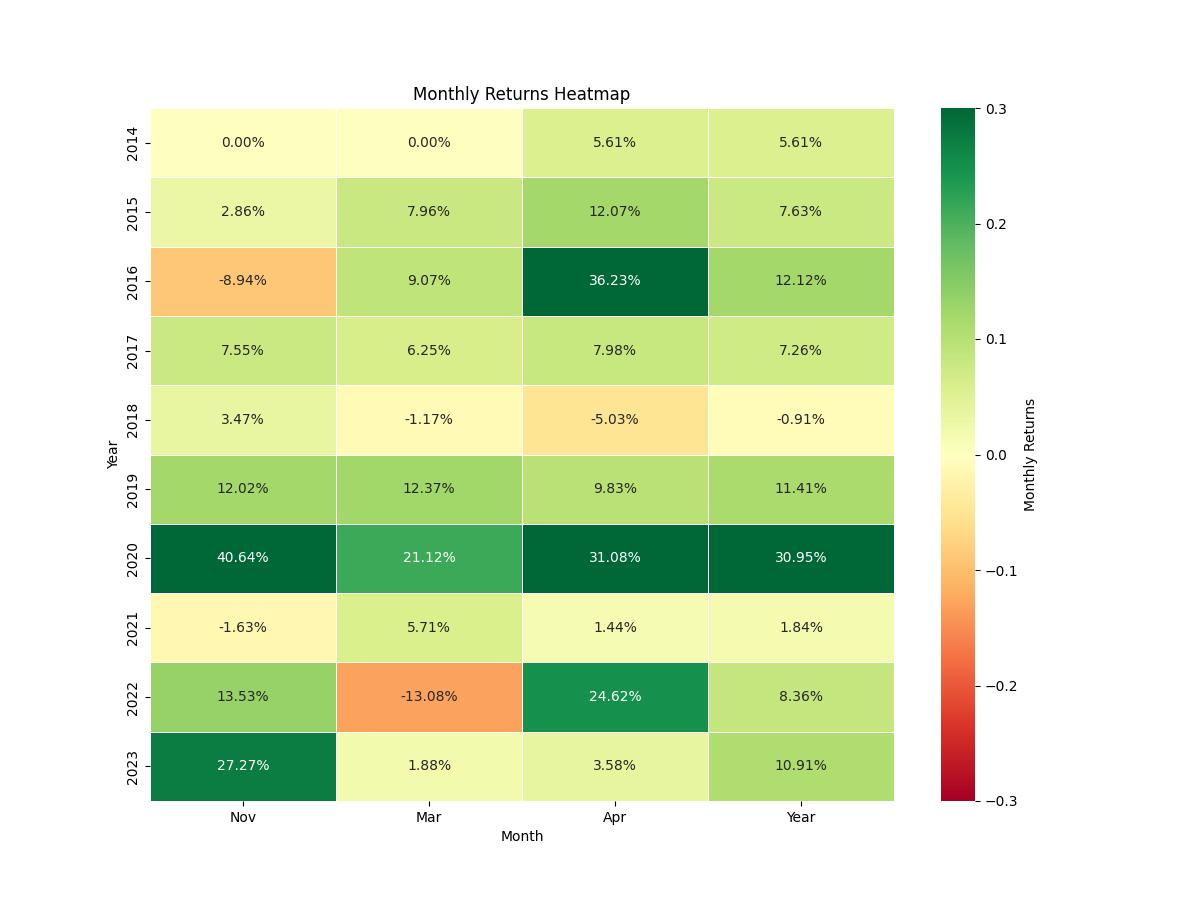

The core of this strategy hinges on the belief that certain months tend to exhibit predictable market behavior for CFG. By adhering to this concept, the strategy involves initiating a long position in the months of January, April, October, and November, and conversely taking a short position for the month of March. A long position is essentially a bet on the stock’s price increasing, while a short position is a wager that it will decrease.

Our backtesting period begins on September 24, 2014, and runs through to December 29, 2023, encompassing a total of 3383 days or just over 9 years of CFG’s stock performance. During this period, the strategy was not always engaged in the market; it was only active 35.49% of the time. This “Exposure Time” is critical as it indicates the strategy isn’t overexposed to market volatility year-round but selectively participates during months historically favorable according to the strategy’s rules.

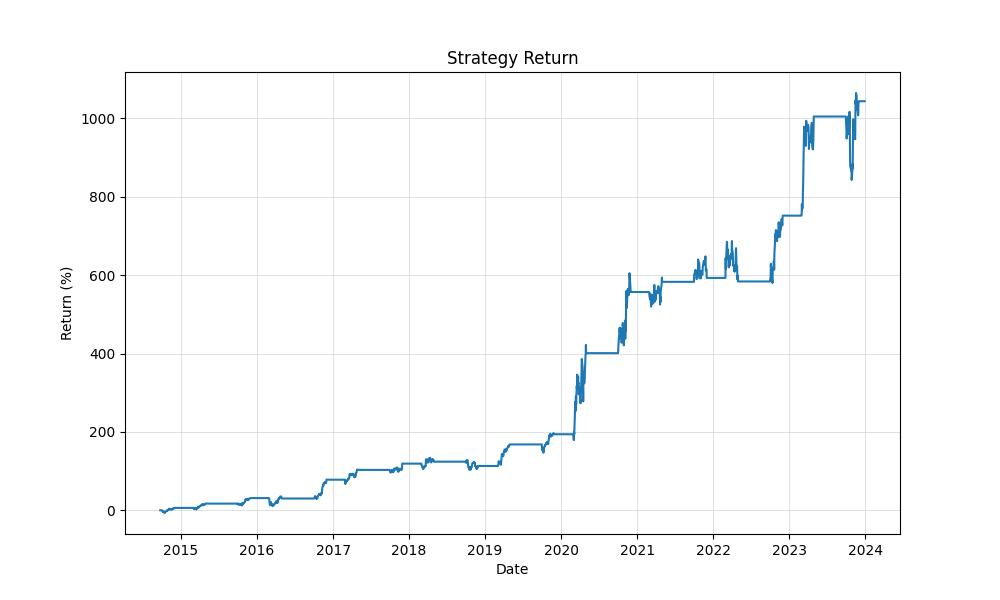

With an initial capital investment of $10,000, the strategy’s implementation over the backtesting period would have resulted in a final equity of $114,426.54, with the peak equity reaching slightly higher at $116,524.54. To put this into perspective, this represents a staggering 1044.27% return on the initial investment. When we compare this performance to the classic buy-and-hold strategy over the same period, which returned 95.51%, the seasonal strategy’s outperformance becomes starkly evident.

Furthermore, the annualized return of the strategy stands at an impressive 30.12%. This figure encapsulates the strategy’s ability to grow the initial investment on an annual basis, showcasing a strong and consistent upward trajectory when compared to the annualized buy-and-hold return of 7.67%.

The study of this monthly seasonality trading strategy paints a vivid picture of its potential. By capitalizing on historical patterns and strategically timing the market, the approach demonstrates a remarkable capacity to outperform a passive investment strategy in CFG stock. For investors intrigued by the rhythm of the market and those seeking to refine their trading based on seasonality, these findings offer a compelling case for further investigation and consideration.

Key Performance Indicators

Investors often gauge the success of a trading strategy by its ability to outperform simple, passive investment approaches such as buy-and-hold. In this context, the backtesting results of the monthly seasonality trading strategy for Citizens Financial Group, Inc. (CFG) reveal some compelling insights.

The strategy, which involves going long in January, April, October, and November, and short in March, has transformed an initial capital of $10,000 into an impressive $114,426.54. This outcome starkly contrasts with the results of a buy-and-hold strategy over the same period, which would have yielded a final equity of $19,818.28. Thus, the seasonality strategy has not only provided substantial growth but has done so at a pace that far exceeds that of the market’s natural ebb and flow.

To put these figures into perspective, the return on investment for the seasonality strategy stands at a staggering 1044.27%, dwarfing the buy-and-hold return of 95.51%. When annualized, the return for the trading strategy is 30.12%, a rate that many investors would find highly attractive, especially when compared to the annualized buy-and-hold return of 7.67%.

The peak equity achieved by the seasonality strategy, which is the highest value the account reached, was $116,524.54. This peak is a testament to the strategy’s ability to capitalize on the most opportune months identified through its seasonal analysis. It is important to consider this peak in relation to the final equity, as it helps to understand the strategy’s ability to sustain gains over time.

The exceptional performance of the seasonality strategy is further underscored when examining the results in the broader context of market behavior. A strategy’s success isn’t just about high returns; it’s also about managing risks and navigating through periods of market volatility. The strong returns achieved by this strategy, paired with the level of risk taken, suggest a well-balanced approach that leverages seasonal patterns without exposing investors to undue volatility.

Risk Management

In the dynamic world of stock trading, the ability to manage risk is as crucial as the pursuit of returns. A closer look at the seasonal strategy applied to Citizens Financial Group, Inc. (CFG) reveals a compelling narrative around managing the inherent uncertainties of the market.

The strategy’s annualized volatility, sitting at 30.83%, offers a telling glimpse into the fluctuation of returns over the backtested period. While this may seem high, it’s important to put this figure in context. Volatility is a double-edged sword; it can erode wealth as quickly as it can create it. In the case of this strategy, such volatility has been a part of the journey toward substantial returns, rather than a detractor.

When we examine the Sharpe Ratio, which stands at 0.9768, we see that the strategy has delivered a commendable level of excess return per unit of risk taken. A Sharpe Ratio close to 1 indicates that investors are being adequately compensated for the additional risks they are assuming over a risk-free investment. This is a reassuring sign for investors who are considering whether the risk taken is justified by the returns.

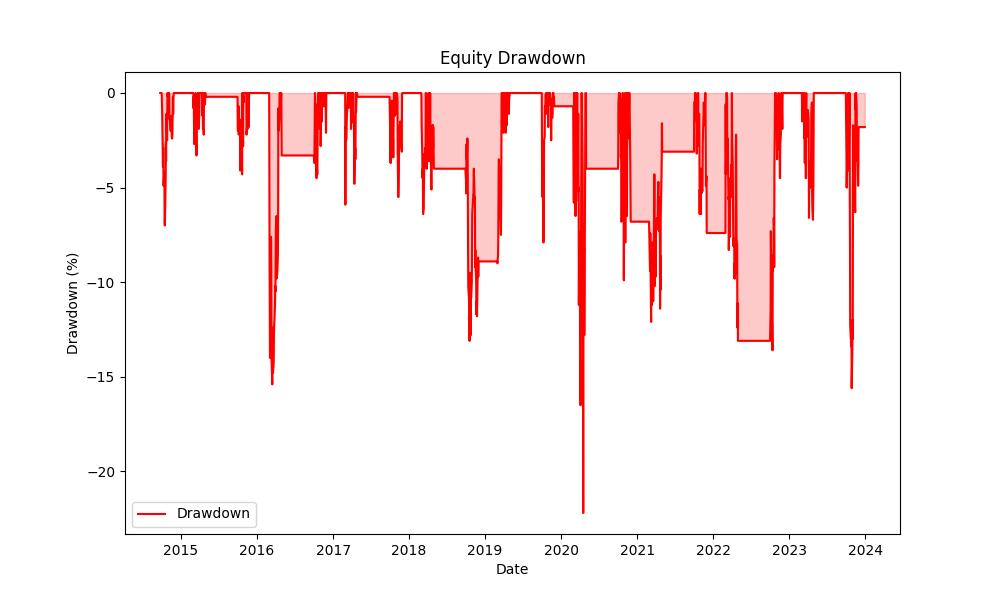

Risk management is further evidenced by the strategy’s maximum drawdown, which is a sobering yet vital metric. The maximum drawdown, standing at 22.25%, represents the largest peak-to-trough decline in the account’s value. This tells us that at its worst point, the strategy’s value saw a significant but not catastrophic drop. In comparison to the buy-and-hold strategy’s maximum drawdown of 65.57%, this is significantly lower, highlighting the efficacy of the seasonal strategy in cushioning against severe market downturns.

Delving deeper, the average drawdown of 4.30% and the average drawdown duration of 31 days show that typical dips in value were not only modest but also relatively brief. This suggests that any losses incurred were regularly and swiftly recovered, allowing the strategy to capitalize on the upside potential of those particularly strong months.

The maximum drawdown duration of 343 days may appear daunting, but it’s essential to evaluate this in light of the overall holding period and the resulting performance. This drawdown period did not prevent the strategy from achieving impressive returns, indicating that patience and a long-term perspective can pay off.

In essence, the risk management aspect of this seasonal trading strategy demonstrates that while the stock market is inherently volatile, a methodical approach can yield desirable results. The strategy has navigated through various market conditions, utilizing a combination of strategic market timing and a disciplined risk framework to turn volatility into an ally for the astute investor.

Trade Analysis

When evaluating the effectiveness of a trading strategy, one of the most revealing aspects is the trade analysis. This scrutinizes how each trade performs under the strategy’s rules, providing valuable insights into the viability of the approach. For Citizens Financial Group, Inc. (CFG), the backtesting results offer a fascinating window into the monthly seasonality strategy’s performance.

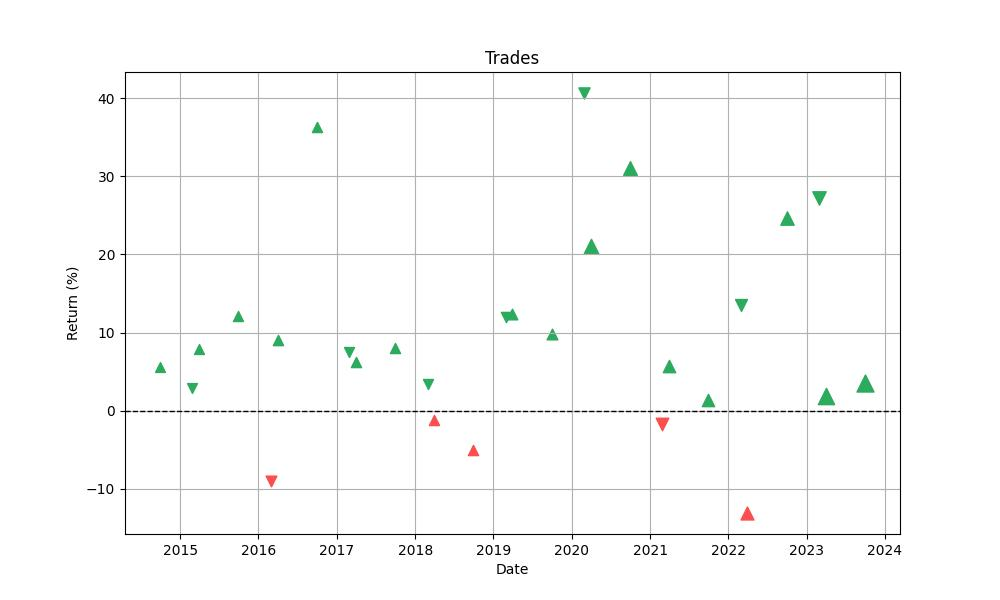

Over the course of the backtested period, a total of 28 trades were executed following the prescribed strategy. An impressive win rate of 82.14% emerges from the data, suggesting that the strategy has a high probability of producing successful trades when applied to CFG. This high win rate is indicative of a strategy that aligns well with the stock’s historical price movements, capturing profitable opportunities effectively.

Diving deeper into individual trades, the best-performing trade yielded a staggering 40.64% return, showcasing the strategy’s potential to capitalize on significant market moves. However, it’s important to remember that no strategy is without risk, and the worst trade reflects a loss of 13.08%. The difference between the best and worst trades highlights the importance of risk management in ensuring the overall success of the strategy.

On average, each trade under this strategy resulted in a 9.10% return, which is a robust figure, especially when compared to the average returns of traditional buy-and-hold strategies. The duration of trades ranged, with the longest trade being held for 63 days and the average trade duration clocking in at 42 days. This suggests a medium-term holding period that balances the need for capitalizing on seasonal trends while not being overly exposed to market volatility.

The Profit Factor, an indicator of the strategy’s profitability, stands at an impressive 10.19. This factor is calculated by dividing the gross profits by the gross losses, and a value above 1 indicates a profitable strategy, with higher values signifying greater profitability. In the case of CFG, a Profit Factor exceeding 10 signals that the gains from the strategy far outweigh the losses, underscoring its effectiveness.

Another critical metric is the Expectancy, which provides an average value for the expected return on each trade. With an expectancy of 9.79%, investors can anticipate a favorable outcome from each trade on average, which is a compelling argument for the strategy’s adoption.

Lastly, the SQN, or System Quality Number, helps assess the market’s performance, risk, and efficiency. The SQN score for the CFG strategy is 2.98, which generally indicates a good system. This number can help traders understand the psychological comfort of trading with this strategy, as higher scores are typically associated with smoother equity curves and less stress for the trader.

The trade analysis of Citizens Financial Group, Inc. through the lens of this monthly seasonality strategy paints a picture of a robust, well-performing system. The high win rate, solid average returns, and exceptional Profit Factor all contribute to the appeal of this strategy for those considering its implementation. However, it’s important for investors to always consider the inherent risks and remember that past performance is not necessarily indicative of future results.

Conclusion

As we conclude our exploration into the seasonal trading strategy for Citizens Financial Group, Inc. (CFG), it becomes clear that the strategy not only promises substantial returns but also stands as a testament to the power of strategic market timing. Through meticulous backtesting, we’ve observed that this approach has the potential to significantly outperform traditional investment strategies, particularly the buy-and-hold method, while effectively managing risk.

The seasonal strategy’s exceptional performance, highlighted by a 1044.27% ROI and a 30.12% annualized return, is not just a result of strategic trades during historically profitable months but also a product of disciplined risk management. The strategy’s impressive Sharpe Ratio and relatively lower maximum drawdown when compared to a passive strategy offer investors a measure of confidence in the face of market volatility.

Trade analysis further reinforces the strategy’s credibility, with a high win rate and a Profit Factor that far exceeds the threshold of profitability. Each trade, on average, has contributed positively to the overall performance, indicating a consistency that investors seek.

However, it’s paramount to remember that the backtested success of this seasonal strategy does not guarantee future results. The stock market is a dynamic entity, influenced by a multitude of factors beyond historical patterns. Investors should regard this strategy as one tool in a diversified investment arsenal, combining it with other analyses and risk management practices to tailor their approach to personal investment goals and risk tolerance.

In the end, the seasonal strategy for CFG illustrates the potential of combining historical insight with disciplined trading. It serves as a compelling example for investors looking to enhance their market engagement through informed, seasonally adjusted strategies. As with all investment approaches, due diligence, continuous monitoring, and a readiness to adapt to changing market conditions remain crucial components for success.

“Make the invisible visible. My goal is to shine a light on the subtle seasonal signals in the stock market, providing investors with the insight needed to make informed decisions. By breaking down the complexities of seasonality, I strive to empower our audience with knowledge and foresight, turning data into action.”