Introduction

As the seasons ebb and flow, so too do the tides of the stock market. To the astute investor, these temporal patterns offer a rhythmic guide to when they might cast their nets for the best catch, or when it may be wiser to stay ashore and mend the sails. In this intricate dance with time, understanding the seasonality of stock markets is not only about recognizing the patterns but also knowing how to chore with them—a skill that can be the difference between a bountiful harvest and coming home empty-handed.

Welcome to our deep dive into the fascinating world of seasonal trading strategies, where we explore the potential of timing the market based on historical monthly performance trends. We will unravel the tale of Rexford Industrial Realty, Inc., a company that has stood as the subject of a meticulous backtest, challenging the winds of time to uncover the viability of a monthly seasonality trading strategy. Our journey will take us through a decade of market fluctuations, revealing the strategy’s performance without the influence of commissions or slippage, and showing how it seeks to harness the cyclical nature of the stock’s performance for an investor’s gain.

What follows is a detailed exploration of the strategy’s backbone—its key performance indicators, the vital importance of risk management, and an analytical breakdown of individual trades. By the end of this voyage, you’ll have a clearer map to navigate the seasonal currents of the stock markets and make informed decisions that resonate with the rhythm of time.

Company Overview

Rexford Industrial Realty, Inc. (REXR) stands as a leading real estate investment trust (REIT) specializing in the acquisition, ownership, and operation of industrial properties throughout Southern California and select U.S. markets. With a robust portfolio exceeding 272 properties totaling over 46 million square feet, REXR caters predominantly to distribution, logistics, and light manufacturing industries. The company’s strategic focus on the highly sought-after Southern California industrial market enables it to capitalize on favorable supply-demand dynamics, driving steady rental growth and occupancy rates. REXR’s unwavering commitment to delivering customized, value-added solutions to its tenants has garnered a loyal customer base, contributing to its reputation as a trusted partner for businesses seeking industrial space. Through strategic acquisitions and organic growth initiatives, REXR continually expands its footprint, capitalizing on market trends and enhancing its long-term growth prospects. Operating in a dynamic industry characterized by e-commerce expansion and evolving supply chain needs, REXR is well-positioned to reap the benefits of these tailwinds, ensuring its continued success as a premier industrial real estate provider.

Strategy Overview

In the dynamic world of stock market investing, one of the intriguing approaches that has piqued the interest of many is the exploration of monthly seasonality as a compass for navigating the ebbs and flows of the markets. A fascinating case study in this realm is the analysis of Rexford Industrial Realty, Inc. (Symbol: REXR), a company that has been the subject of a backtest examining the viability of a monthly seasonality trading strategy.

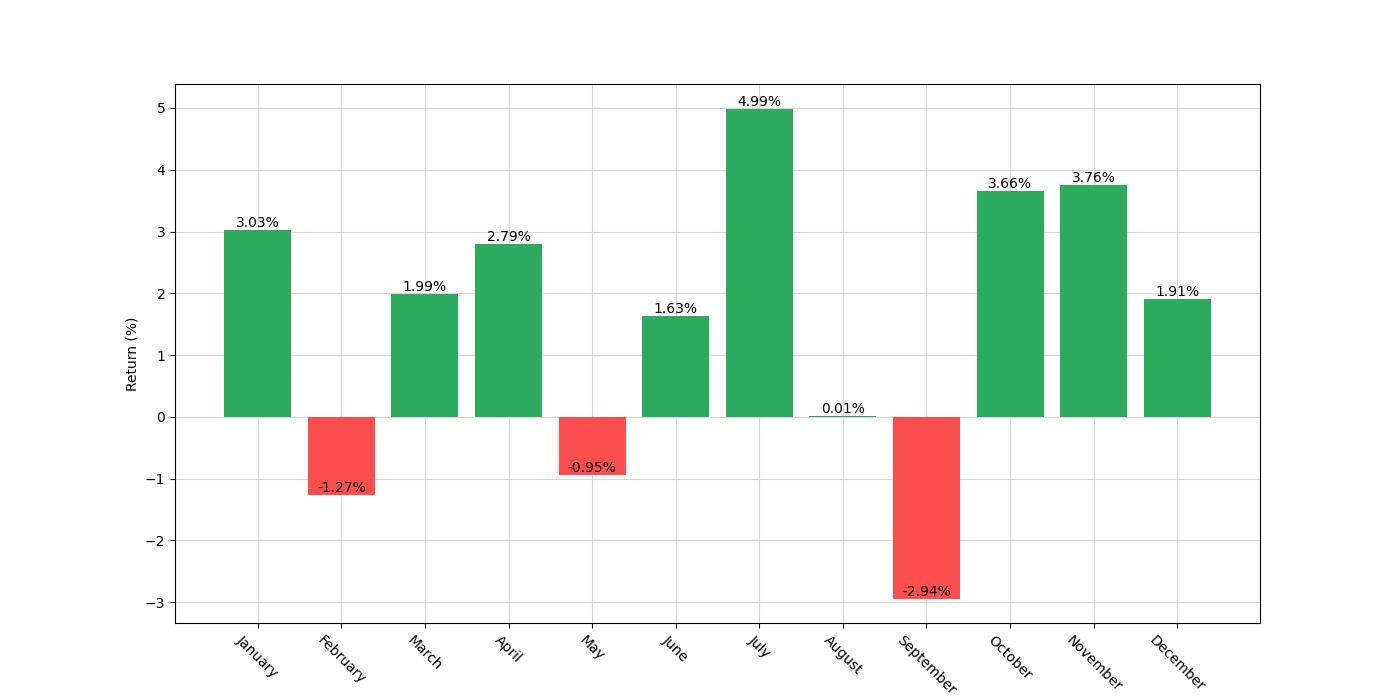

This strategy, devoid of the influence of commissions or slippage, hinges on the historical performance patterns of the company’s stock over a specific set of months. The premise is straightforward—by initiating long positions during the months of April, June, July, October, and November, and conversely taking a short position in May, the strategy aims to capitalize on the recurring temporal trends observed in the stock’s performance.

Delving into the mechanics of the backtest, we see that it spans a notable duration, commencing on July 19, 2013, and drawing to a close on December 29, 2023. This ten-year period, encompassing 3,815 days, provides a robust temporal canvas to evaluate the strategy’s effectiveness. Throughout this interval, the strategy’s market exposure stands at approximately 50.51%, implying that the investor’s capital is actively deployed in the market for roughly half the time. This targeted engagement is designed to optimize returns while potentially mitigating risk by avoiding market participation during historically less favorable periods.

Starting with an initial capital of $10,000, the strategy’s performance over the course of the backtesting period is worth noting. By the end of the backtest, the equity of the portfolio swells to an impressive $55,359.17, with the peak equity reaching $59,698.06. When we translate this growth into percentages, the strategy boasts a return of 453.59%, which is particularly striking when compared to the buy and hold return of 418.55% for the same period. This suggests that the strategy not only captured the intrinsic growth of the stock but also leveraged the seasonality aspect to enhance returns.

Another compelling facet of this strategy is the annualized return, which stands at 17.81%. This figure provides a more granular perspective on the strategy’s performance, smoothing out the returns over the years to present a clearer picture of what investors might expect on an average yearly basis.

Through this strategic lens, the backtest results of Rexford Industrial Realty, Inc. offer a window into the potential of using seasonality as a cornerstone for trading decisions. While past performance is not indicative of future results, the empirical data from this backtest serves as a testament to the merit of considering temporal trends in formulating investment strategies. Such an approach can be particularly appealing for retail investors who are seeking to refine their investment tactics with an eye on the calendar.

Key Performance Indicators

In examining the backtest results of the monthly seasonality trading strategy for Rexford Industrial Realty, Inc. (REXR), we uncover some fascinating insights into the strategy’s performance over a span of just over a decade, from July 19, 2013, to December 29, 2023. During this period, the initial investment of $10,000 would have grown to an impressive $55,359.17. This represents a substantial return of 453.59%, which is quite significant when compared to the 418.55% generated by a simple buy-and-hold strategy over the same timeframe.

To put these returns into a yearly context, the strategy resulted in an average annual return of 17.81%. This annualized figure provides a clearer picture of what an investor might expect year over year, though it’s important to remember that returns in any given year can vary widely. For comparison, the buy-and-hold approach yielded slightly lower annual returns, averaging 17.27%. This suggests that the seasonality trading strategy not only outperformed in overall returns but also edged out the passive approach on an annualized basis.

At the peak of the strategy’s performance, the equity value reached nearly $59,698.06. This peak equity is a useful indicator of the strategy’s highest value point before any subsequent drawdowns, giving investors an idea of the potential heights the strategy can reach.

While these returns are undoubtedly appealing, they do not come without risk, a factor that all investors must consider. However, in this case, the seasonality strategy demonstrates resilience with returns exceeding the inherent risks when measured by traditional financial metrics.

Risk Management

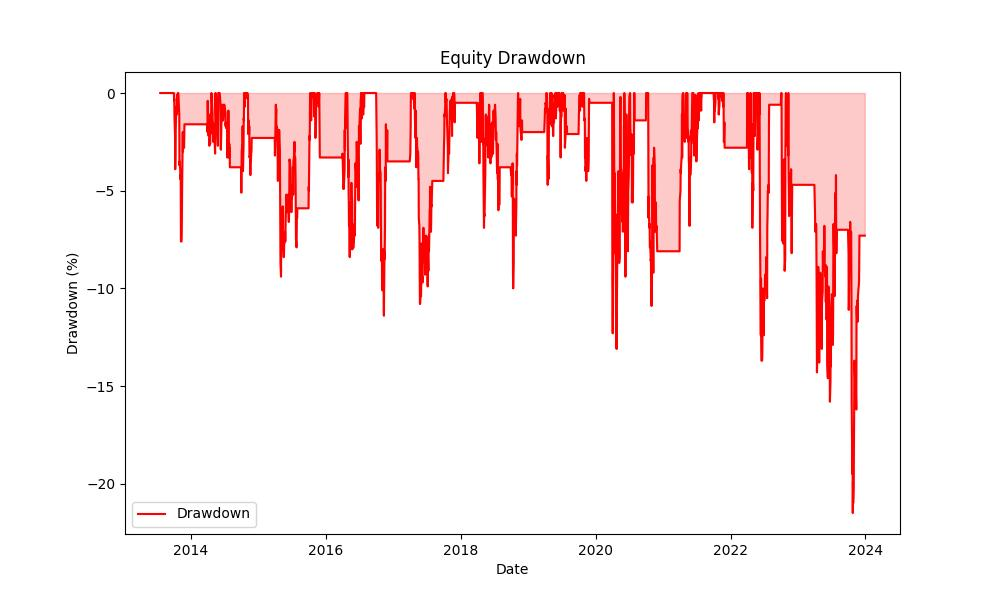

When evaluating the performance of a trading strategy, understanding the associated risks is paramount. This is where risk management metrics come into play, providing insight into the potential volatility and drawdowns an investor might experience.

The annualized volatility of the monthly seasonality strategy for Rexford Industrial Realty, Inc. stands at 19.99%. This figure represents the degree of variation in the trading strategy’s returns compared to its average over a one-year period. In comparison to a buy-and-hold strategy, which had a higher annualized volatility of 29.67%, our strategy exhibits less fluctuation in returns, suggesting a relatively more stable performance throughout the investment period.

The Sharpe Ratio, which measures the excess return per unit of deviation in an investment, is 0.89 for our strategy. Though below the ideal threshold of 1 or higher, it still indicates a decent risk-adjusted return, especially when compared to the buy-and-hold strategy with a Sharpe Ratio of 0.58. This suggests that the seasonal strategy provided a better return for the risk taken.

When looking at the Max. Drawdown, which reflects the largest peak-to-trough decline in the account’s equity value, our strategy had a maximum drawdown of 21.53%. In contrast, the buy-and-hold approach experienced a substantially higher Max. Drawdown of 48.36%. This stark difference highlights the risk mitigation inherent in the seasonal strategy, which could appeal to investors who are risk-averse.

Diving deeper, the average drawdown for the strategy was -3.58%, indicating that typical dips in equity were modest. Additionally, the average drawdown duration was 47 days, which suggests that the strategy typically recovered from drawdowns in a relatively short period. This is favorable when compared to the buy-and-hold average drawdown duration of 31 days, as it’s important to consider that a single long-duration drawdown can significantly impact the latter’s metric.

Furthermore, the Calmar Ratio, which relates the annualized return to the maximum drawdown, is 0.83 for our seasonal strategy. This ratio offers a perspective on how well the strategy’s performance compensates for the intermittent periods of decline. Although not exceedingly high, it’s still a respectable figure, particularly when compared to the 0.36 Calmar Ratio of the buy-and-hold approach, underscoring the superior risk-adjusted performance of the seasonal strategy.

Trade Analysis

Delving into the trade analysis of Rexford Industrial Realty, Inc. (REXR) reveals an intricate picture of how a monthly seasonality trading strategy has performed over a span of roughly a decade. This analysis is crucial for retail investors who are considering the adoption of similar strategies for their portfolios.

A total of 41 trades were executed based on the predetermined rules of going long during the months of April, June, July, October, and November, and taking a short position during May. This number of trades highlights the strategy’s selectivity, focusing on specific periods to capitalize on anticipated seasonal trends.

The win rate of this strategy stands at an impressive 75.61%. This suggests that three out of every four trades, on average, concluded profitably – a compelling figure that may pique the interest of investors looking for consistent performance. However, it’s important to note that past performance is not indicative of future results, and a high win rate doesn’t guarantee future success.

The strategy’s best trade boasted a remarkable 23.49% return, showcasing the potential upside that can be captured during favorable market conditions. On the flip side, the worst trade resulted in a loss of 9.26%. While losses are an inevitable part of trading, this strategy’s controlled worst-case scenario may provide some consolation to risk-averse investors.

When it comes to the average trade outcome, the strategy achieved a gain of 4.26%. This indicates that, on average, each trade contributed positively to the overall growth of the portfolio. The consistency of these average gains is an encouraging sign for investors.

In terms of duration, trades lasted an average of 47 days, with the longest trade spanning 63 days. This relatively short average trade duration allows for quick turnover and the potential to compound gains more effectively over the course of a year.

The Profit Factor, which is the ratio of gross profits to gross losses, is recorded at 6.08 – a strong indicator that the gains vastly outpaced losses. This is a crucial metric for investors as it underscores the strategy’s effectiveness in generating profits.

Lastly, the Expectancy of 4.51% provides an estimate of the average return one could expect per trade. It takes into account both the probability of winning and the amount won compared to the amount lost. This positive expectancy is an affirming statistic for investors as it suggests that over time, the strategy could be expected to yield profitable outcomes.

Conclusion

As we conclude our exploration of the monthly seasonality trading strategy applied to Rexford Industrial Realty, Inc. (REXR), it’s evident that the strategy has demonstrated a robust performance over the analyzed period. By capitalizing on historical seasonal patterns, the strategy has outpaced the traditional buy-and-hold approach, providing investors with not just higher returns but also a more stable investment journey.

The strategy’s impressive win rate, coupled with a controlled average drawdown and swift recovery periods, illustrates a systematic approach that balances potential gains with prudent risk management. The lower volatility and superior risk-adjusted returns, as evidenced by the Sharpe and Calmar ratios, suggest that the strategy could be an attractive alternative for those looking to introduce more structure and predictability to their investment process.

While the past performance of this seasonal strategy is no guarantee of future results, the empirical evidence provided through this decade-long backtest offers a compelling case for the consideration of seasonality in investment decision-making. It’s a reminder to investors that there are myriad approaches to navigating the stock market, and with careful analysis and strategic implementation, seasonality can be more than just an interesting market anomaly—it can be a powerful tool in an investor’s arsenal.

In the world of investing, where uncertainty is the only certainty, strategies like the one applied to REXR offer a glimpse of how data-driven insights can potentially lead to more informed and potentially more successful investment outcomes. As we continue to witness the evolution of financial markets, the integration of such strategic considerations is likely to play an increasingly pivotal role for the discerning investor.

“Make the invisible visible. My goal is to shine a light on the subtle seasonal signals in the stock market, providing investors with the insight needed to make informed decisions. By breaking down the complexities of seasonality, I strive to empower our audience with knowledge and foresight, turning data into action.”