Introduction

In the dynamic world of stock trading, where fortunes can be made or lost with the ebb and flow of market tides, the concept of seasonality offers a fascinating lens through which investors can view potential investment opportunities. Seasonality refers to the recurring patterns in stock prices at certain times of the year, which can be the result of various factors including tax considerations, earnings reports, and macroeconomic data releases.

As an eloquent Content Writer with a specialty in demystifying the complexities of the stock market, it’s my privilege to introduce you to the intriguing realm of seasonality and its application in trading strategies. Today, we will explore how historical patterns can be harnessed to inform investment decisions, using Antero Midstream Corporation as our case study. This energy sector entity has shown particular promise when analyzed through the prism of seasonal trends.

Our journey will uncover the mechanics behind a trading strategy that has been meticulously backtested over a period of nine years, and we will reveal the compelling results of this approach. By assessing the peaks and troughs of Antero Midstream Corporation’s stock within the context of seasonal shifts, we aim to provide you with a clear understanding of how timing can be just as crucial as stock selection in your investment portfolio.

Whether you are a seasoned investor or new to the world of trading, the insights yielded from this seasonal approach could be a game-changer in the way you perceive and engage with the stock market. So, let us embark on this educational adventure together, as we shed light on the temporal patterns that could lead to more informed and potentially profitable trading strategies.

Company Overview

AM Antero Midstream Corporation, headquartered in Denver, Colorado, stands as a leading provider of midstream energy services in the prolific natural gas basins of the United States. Founded in 2017, the company’s mission is to deliver innovative and responsible midstream solutions that support the upstream success of its customers.

AM Antero Midstream’s core offerings encompass a comprehensive range of midstream services, including natural gas gathering, processing, compression, and transportation. The company operates an extensive network of pipelines, processing plants, and compression stations in West Virginia, Ohio, and Pennsylvania, catering primarily to the needs of producers in the Marcellus and Utica Shale regions.

AM Antero Midstream’s revenue streams are predominantly derived from natural gas transportation and processing fees, as well as a smaller portion from gathering and compression services. The company’s value proposition lies in its commitment to operational excellence, reliability, and a customer-centric approach.

Adopting a fee-based business model, AM Antero Midstream ensures stable and predictable cash flows, reducing exposure to commodity price fluctuations. Its long-term contracts with reputable producers provide a solid foundation for consistent revenue generation.

To drive growth, AM Antero Midstream focuses on expanding its existing infrastructure, pursuing strategic acquisitions, and optimizing its operational efficiency. The company’s expansion plans involve extending its pipeline network, increasing processing capacity, and adding compression stations to accommodate rising production volumes in its target basins.

The company operates in a highly competitive industry, characterized by the presence of established players and emerging entrants. AM Antero Midstream differentiates itself through its strong relationships with producers, its commitment to environmental stewardship, and its proven track record of delivering reliable and cost-effective midstream services.

AM Antero Midstream’s strategic initiatives and solid operational foundation position it well for continued growth and success in the evolving energy landscape. The company’s commitment to responsible operations and its alignment with the ESG (Environmental, Social, and Governance) principles further enhance its long-term prospects.

Strategy Overview

Antero Midstream Corporation (AM), a player in the energy sector, has been the subject of an intriguing seasonal trading analysis. Let’s delve into the heart of this approach, which leverages the cyclical nature of equity markets. The strategy is straightforward yet methodical, focusing on the close-to-close price movements over specific months that historically exhibit recurring patterns.

Initiated with an initial capital of $10,000, the strategy operates under a set of rules that dictate the market positions to be taken at given times of the year. Specifically, the strategy calls for establishing long positions during the months of April, May, and October. In contrast, it suggests taking short positions in March, September, and November. These decisions are not random; they are based on historical data suggesting that these months offer the most predictable and favorable returns for AM.

The backtesting period for this strategy spans from November 5, 2014, to December 29, 2023, covering over nine years of market activity. This substantial duration, accounting for 3341 days, allows for a comprehensive assessment of the strategy’s effectiveness through various market conditions.

Investors often worry about overexposure to the market’s volatility; however, this strategy maintains a market exposure of approximately 50.33%. This figure indicates that for half of the backtested period, the strategy was actively engaged in trades, while the other half allowed for a step back, potentially reducing risk during less predictable times.

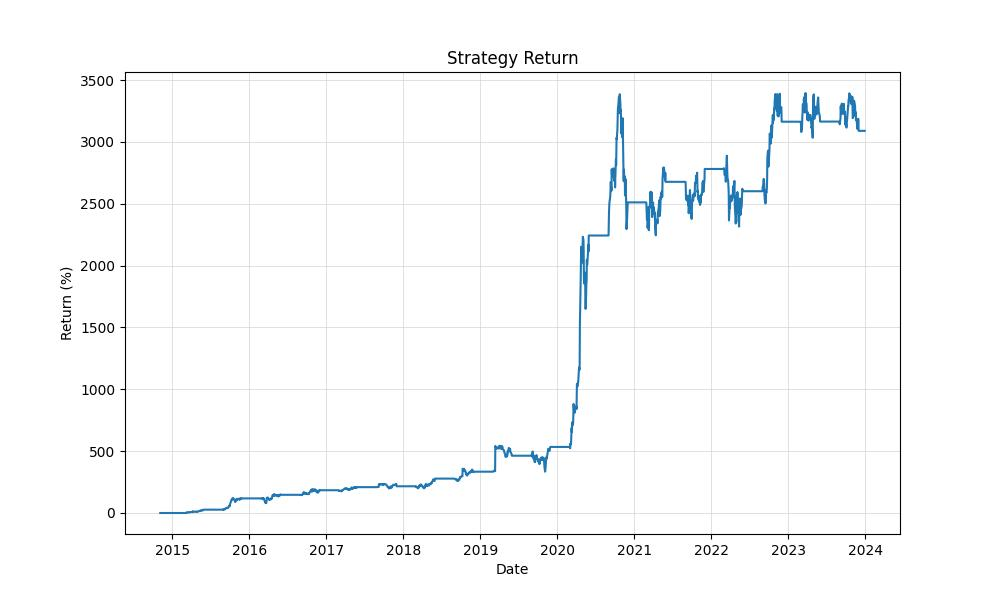

Understanding the implications of this strategy requires a peek into its backtesting results, which are nothing short of impressive. By the end of the backtesting period, the equity final stood at a staggering $318,864.15, with the equity peak reaching even higher at $349,538.69. The strategy yielded a remarkable return of 3088.64%, dwarfing the buy and hold return of -2.32%. When annualized, the return sits at an attractive 46.06%. This stark contrast with the buy and hold approach, which would have resulted in a slight loss, underlines the potential efficacy of a well-crafted seasonal trading strategy.

Investors, both seasoned and newcomers, will find these insights revealing, as they underscore the potential of using historical patterns to guide trading decisions. Moreover, the strategy’s performance during the specified backtesting period provides a compelling case for considering seasonality as a cornerstone of trading approaches for assets like Antero Midstream Corporation.

Key Performance Indicators

As an investor eyeing Antero Midstream Corporation (AM), you might be intrigued by the results of a seasonality-based trading strategy that has been put to the test. This approach capitalizes on the company’s stock performance tendencies during certain months of the year, with an analysis period stretching from November 2014 to December 2023.

The backbone of this strategy involves taking a long position in AM during what appears to be its favorable months, namely April, May, and October. Conversely, it advocates for a short position during months that historically show weaker performance: March, September, and November. This cyclical pattern allows investors to potentially benefit from the stock’s predictable ebb and flow throughout the year.

Now, let’s delve into the fruits of this strategy. Initially fueled by a $10,000 investment, the strategy’s equity ballooned to an impressive $318,864.15 by the end of the test period. To put this into perspective, the peak equity reached during this period was even higher, at $349,538.69. This suggests that there were moments when the investment’s value soared even beyond the final figure.

In terms of percentage growth, the strategy delivered a staggering 3088.64% return. This figure is particularly striking when compared to the buy-and-hold strategy, which would have resulted in a slight decline of 2.32%. On an annualized basis, the seasonal trading strategy’s return sits at an eye-catching 46.06%, a robust figure that showcases the potential power of tactical, time-specific investments in AM’s stock.

While some investors may be chasing the thrill of high returns, it’s essential to also consider the consistency and reliability of those returns. The annualized return of the strategy should be seen as an average and does not guarantee that each year will produce identical outcomes. However, it does offer a glimpse into the strategy’s potential when applied over multiple years.

It’s important to note that the exceptional performance of this seasonality-based strategy isn’t without its risks. Equity markets are inherently volatile, and not even the most meticulously crafted strategy is immune to the market’s whims. In this case, the annualized volatility was reported at 50.26%, indicating a relatively high level of fluctuation in the investment’s value over time. While high volatility can mean higher risk, it can also present more opportunities for substantial gains, which this strategy seems to have capitalized upon.

The balance between risk and return is often measured by the Sharpe Ratio, which, for this strategy, stands at 0.916. This ratio, while less than 1, still indicates that the excess return of the strategy over the risk-free rate is relatively favorable, given the level of risk taken.

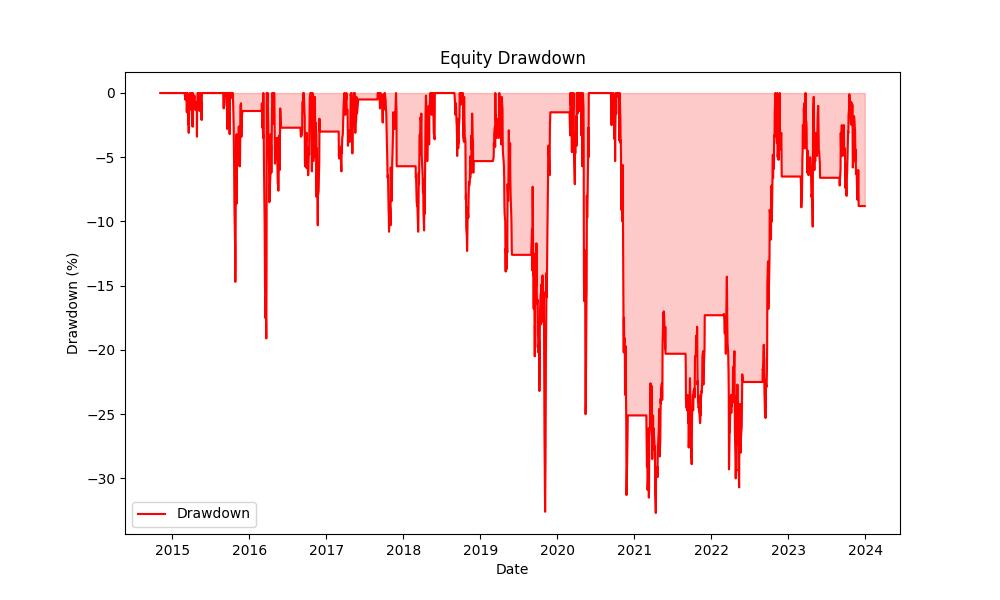

When investing, one must also consider the drawdowns, which are the peak-to-trough declines in investment value. The maximum drawdown experienced during the backtested period was 32.70%, highlighting the potential for significant temporary declines. However, the average drawdown was much lower, at 5.09%, suggesting that while the strategy may encounter some bumps, the typical downturn is not as severe.

Investors should pay attention to drawdown duration as well, which measures how long it takes for an investment to recover from a drawdown. The maximum drawdown duration was 738 days, a considerable amount of time that would require patience and confidence in the strategy’s eventual rebound. On average, the strategy experienced drawdown durations of around 45 days, which is a relatively short recovery period and may provide some reassurance to investors concerned about prolonged dips in their investment’s value.

Risk Management

When it comes to investing, understanding the risks involved is as crucial as spotting opportunities. In the case of the monthly seasonality trading strategy applied to Antero Midstream Corporation (AM), there are several risk management metrics that investors should consider to gauge the strategy’s robustness and their risk tolerance alignment.

The annualized volatility of this strategy, which measures the degree to which the investment’s returns deviate from its average return, stands at 50.26%. This suggests that the strategy entails a high level of fluctuation in its returns, which could imply significant ups and downs in the investment value over time. High volatility often indicates higher risk, as the value of the investment can change dramatically in a short period, potentially leading to substantial gains or losses.

One of the key metrics used to understand the risk-reward profile of an investment strategy is the Sharpe Ratio, which in this case is 0.916. The Sharpe Ratio helps investors to understand how much excess return they are receiving for the extra volatility that they endure for holding a riskier asset. A Sharpe Ratio greater than 1 is typically considered excellent, between 0.5 and 1 is good, and less than 0.5 is considered suboptimal. Here, the ratio is close to 1, indicating that investors are receiving a near-optimal return for each unit of risk taken.

The maximum drawdown is a metric that shows the greatest peak-to-trough decline in the investment’s value before a new peak is achieved. For this strategy, the maximum drawdown is -32.70%, which is a sizable drop, suggesting that at some point, the investment’s value saw a significant decline from its peak. This is a critical indicator for investors as it provides a sense of the potential losses that might occur during a risky period.

In addition to the maximum drawdown, it’s important to consider the average drawdown, which was -5.09%. This gives a more routine view of what typical declines might look like, rather than the worst-case scenario. Moreover, the average drawdown duration was 45 days, indicating that on average, it took about a month and a half for the investment to recover from its dips.

However, one should also note the duration of the maximum drawdown, which lasted 738 days. This is a significant period that investors would have had to endure a peak-to-trough decline without seeing a new peak in their investment’s value. It’s a testament to the strategy’s potential for long-term downturns, and it highlights the importance of patience and long-term commitment when dealing with high volatility investments.

Together, these risk management indicators provide a comprehensive view of the potential upsides and downsides of this seasonality trading strategy. While the strategy has demonstrated the ability to generate substantial returns, the associated risks, as indicated by the volatility and drawdown figures, should not be overlooked. As with any investment strategy, aligning one’s risk tolerance with the risk profile of the strategy is essential to maintaining a balanced and comfortable investment approach.

Trade Analysis

When delving into the mechanics of a trading strategy, one of the most revealing aspects is the examination of its trade performance metrics. In this exploration, we’re focusing on the trade analysis of the Antero Midstream Corporation (AM) monthly seasonality strategy, which has garnered attention due to its distinctive approach and results.

The strategy, operational from November 5th, 2014, to December 29th, 2023, has executed a total of 45 trades. The significance of this number lies not only in its testament to the strategy’s active engagement with the market but also in the data it provides for performance assessment. With nearly a decade of trades to analyze, we can draw conclusions with a higher degree of confidence.

A standout feature of the strategy is its impressive win rate of 75.56%. This means that out of every four trades, three have been profitable, a robust indicator of the strategy’s effectiveness. High win rates are often pursued by investors, as they can suggest a level of predictability in returns, although they should always be considered in the context of other performance metrics.

Digging deeper, the best trade within this period yielded a staggering 143.17% return, a figure that can capture any investor’s attention. On the flip side, the worst-performing trade saw a loss of 17.63%. While losses are an inevitable part of trading, the stark contrast between the best and worst trades underscores the potential volatility and the importance of risk management within this strategy.

On average, each trade resulted in a return of approximately 8.00%. This consistent performance is indicative of a strategy that, more often than not, delivers solid gains. The average trade duration stands at 37 days, while the maximum duration for a trade was 63 days. These durations reflect a medium-term holding period, which aligns with the monthly seasonality approach of the strategy. It strikes a balance between the rapid turnover of high-frequency trading and the prolonged exposure of buy-and-hold strategies.

Another critical factor in trade analysis is the Profit Factor, which in this case is 6.44. This metric gives us an insight into the profit generated for every dollar of loss. A Profit Factor greater than one suggests a profitable system, and at 6.44, it indicates that the strategy is generating significant returns relative to the losses incurred.

The Expectancy of 9.86% further illustrates the average amount an investor can expect to win or lose per trade. In positive territory, as it is here, it means that on average, each trade contributes positively to the overall equity.

However, it’s also vital to approach these figures with a level of scrutiny. While the win rate, best trade, and expectancy are highly encouraging, they must be weighed against potential risks and the reality of market conditions. The absence of commissions and slippage in the backtesting could mean that real-world results would differ, potentially narrowing the margins of profitability.

Conclusion

In conclusion, the seasonal trading strategy applied to Antero Midstream Corporation (AM) demonstrates a compelling case for the practical application of historical patterns in trading decisions. The impressive performance metrics, including a final equity that far surpasses the initial investment and a remarkable annualized return, suggest that this strategy can offer considerable gains when executed with discipline and adherence to its seasonal principles.

However, as we’ve journeyed through the analysis, it’s clear that while the returns are enticing, they come with inherent risks. The strategy’s volatility and drawdowns reflect the potential for significant fluctuations and periods of decline, which investors must be prepared to weather. The risk-reward balance, as evidenced by the Sharpe Ratio, indicates that the strategy has historically provided favorable returns for the level of risk incurred, yet it is imperative that investors align their risk tolerance with the strategy’s profile.

The granular view of trade performance highlights the strategy’s robust win rate and the noteworthy returns of successful trades, lending confidence to the approach. Nevertheless, the scrutiny of trade analysis reminds us that past performance is not a guarantee of future results, and market conditions can rapidly alter the landscape of any trading strategy.

Ultimately, the seasonality-based trading strategy for AM stock offers an illustrative example of how systematic, time-specific investments can capitalize on market tendencies. Investors looking to incorporate such a strategy must do so with a clear understanding of the associated risks, a commitment to ongoing analysis, and an appreciation for the complex nature of the stock market’s seasonal ebbs and flows. With these considerations in mind, seasonality could indeed become a cornerstone of a strategically diversified investment portfolio.

“Make the invisible visible. My goal is to shine a light on the subtle seasonal signals in the stock market, providing investors with the insight needed to make informed decisions. By breaking down the complexities of seasonality, I strive to empower our audience with knowledge and foresight, turning data into action.”